猛牛

以历史为借鉴, 以现实为根据, 以独立判断为基础, 以长期投资为目标, 以基本面分析为手段, 来谋求理想的长期盈利。

博文

(2018-05-13 17:07:41)

不要管短期如何走,

一个字,买。

二个字,大买。

三个字,使劲买。

四个字,大买特买。

之后短期如果真的走低,那是牛牛的运气,可以买到便宜一点货。

之后短期如果真的绝尘而去,那也是牛牛的运气,可以很快看到账户暴涨。

YMTD

呵呵呵。。。。。。。。

[阅读全文]

(2018-05-09 20:29:37)

因为盲人摸象。

所以不要只抱着你的象腿,也不要只抱着你的象鼻子。。。。。

?首先要有个动物的概念,在头脑里,这是大方向。

股市也是一样,先搞清大方向,不要天天抱着单一因素(象腿,象鼻):

债券利率,贸易战,退出啥协议,。。。等等

呵呵呵。。。。。。

[阅读全文]

(2018-05-09 19:59:09)

俺有临时仓位需要卖的

为什么说是临时呢?就是见机行事的仓位。

股市给了机会就炒底买入。

接近新高就卖出,因为

(1)后面上涨就会慢下来。

(2)有可能反复。

长期仓位,在经济变差时会卖出的。这不一定卖在最高,

但能获得牛市最大利润的80-90%.

呵呵呵。。。。。。

[阅读全文]

(2018-05-09 06:29:15)

https://www.marketwatch.com/story/slowing-growth-stalling-stocks-raise-fear-that-economys-good-days-are-numbered-2018-05-07[阅读全文]

(2018-05-08 06:29:05)

https://www.marketwatch.com/story/heres-why-peak-earnings-dont-mean-its-all-downhill-for-the-stock-market-2018-05-07[阅读全文]

(2018-05-05 16:08:46)

太多的钱不在股市里,都在外面等着。 (1)房价那么高,没有赚头, (2)债券价格那么高,FED加息,价格走低。 (3)CASH吧,通胀为2%,每年贬值2% 只有股价已有调整,估值适中,前途看好。 看看下面的支票账户的历年余额就知道,大量大量的闲钱在外面等着。支票账户只是个缩影而已,就算全进股市回到历史水平也只有$1000-1500B,而大量的闲钱可能有几万或几十[阅读全文]

(2018-04-29 17:21:45)

牛牛的好日子,快来了。

拭目以待。。。。。。。

[阅读全文]

(2018-04-29 16:43:09)

OneFidelityexpertlookstopastcorrectionsforcluestotoday'sopportunities.Keytakeaways Since1960,therehaveonlybeen10correctionsintheUSstockmarketassteepandfastasthepullbackinFebruary,whichhada10%declinein9tradingdays. Historically,stockshavegenerallyperformedwellaftersuchsharpcorrections,withpositive12-monthreturnsfollowing8ofthe10corrections,andanaveragegainof17%. Lookingbackto1955,themarkethasha...[阅读全文]

(2018-04-29 14:51:07)

https://www.seeitmarket.com/2018-stock-correction-5-historical-examples-market-returns-17786/FACTSINSTEADOFFEARInaseparatepost,wecompared2018tonumerousplungeperiodsinhistory(1955,1987,1998,2000,2007,2011,and2015).Havingstudiedmarketsforyears,wecanconfidentlysaythedatawehaveinhandin2018,onmultipletimeframes,looksalmostnothinglikethedatawehadinhandbeforeplungesin2000and2007.Themostsimilarperiodsare1...[阅读全文]

(2018-04-29 14:44:19)

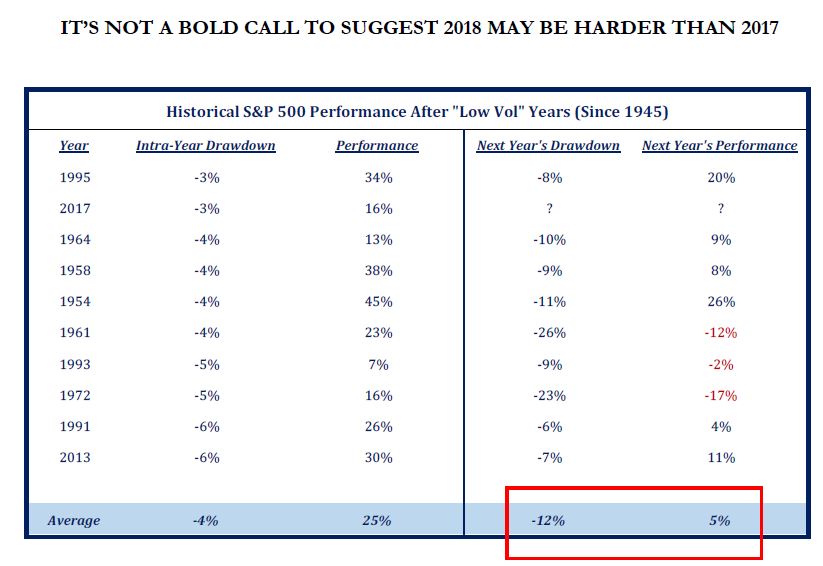

Historyisonthesideofthosewhothinkstockswillseesmallergainsnextyearandacorrection. Strategasanalystsstudiedyearswheretherewereshallowsell-offsintheS&P500,likethisyear,andtheyfoundtheycorrelatedtostrongmarketperformance,likethisyear. Butinthefollowingyear,therewasanaverage12percentcorrectionandanaveragegainofjust5percent,coincidentallyjustlikeanalystsareforecastingfornextyear. St...[阅读全文]