Canada has historically had a reputation as a safehaven to global investors, but those days are suddenly gone. Statistics Canada (Stat Can) released its securities trade for February. The data revealed global capital continues to flee the country’s capital markets at a record pace. Even worse, domestic investors are now joining them.

Canadian Investors Flee To Foreign Securities, Sets Record For Bonds

Canadian investors are sinking record amounts of cash into foreign markets. Investors bought $24.2 billion in foreign securities in February, after sending $7.6 billion in January. Most of the capital was sunk into foreign bonds, setting a record.

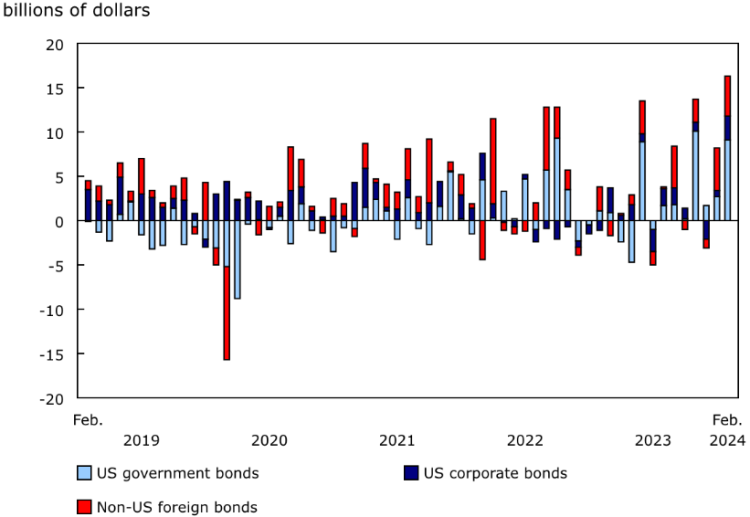

Canadian Investors Are Sinking Record Cash Into Foreign Bonds

Monthly distribution of the net flow of Canadian capital into foreign bonds. Positive numbers indicate more capital sunk into foreign bonds than withdrawn.

Source: Statistics Canada.

The US was the biggest winner of Canadian investors chasing foreign investments. In total, a record of $16.3 billion in foreign bonds were purchased in February. American bonds represented $9.1 billion of that flow. That was on top of the $9.1 billion in US equities purchased by Canadians in the month.

Foreign Investors Continue To Flee Canada, Anything But Loonies

Canadians weren’t leading the trend, but joining the global capital flight from the country. Foreign investors dumped $8.8 billion worth of securities in February. This follows an unusually busy period of divestment over the past 3-months, amounting to a $31.0 billion sell off.

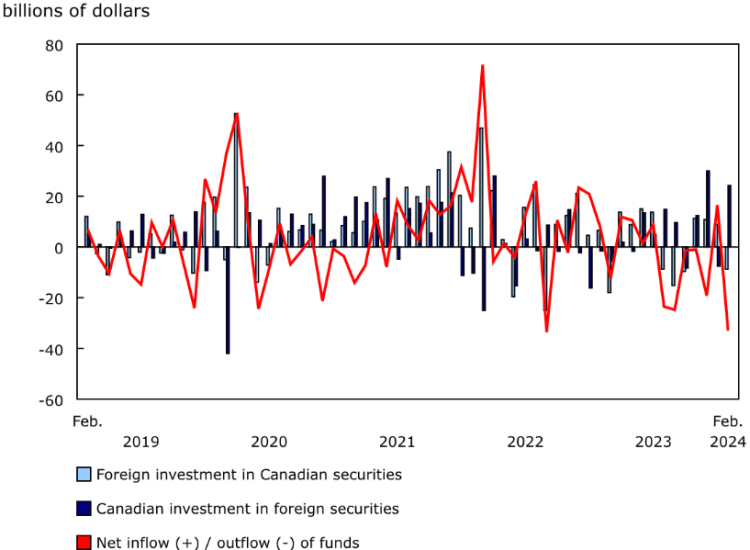

Canada Is Seeing Domestic & Foreign Investors Pull Their Cash

Canada’s net flow for international securities—the balance of money flowing into capital markets. If the net flow is negative, more capital left than arrived.

Source: Statistics Canada.

In addition, foreign investors reduced an “unprecedented” amount of government paper, a catchall term for debt securities. They reduced holdings by $15.1 billion in February. It broke down into $11.8 billion in Federal, and $3.3 billion in provincial paper. This follows a record $15.5 billion sell off of private paper in January.

The one highlight was Canadian corporate bonds, which saw a mild bounce. Foreign investors scooped up $13.3 billion in February, the highest monthly haul in a year. The catch is they were led by US dollar denominated bonds, issued by Canadian banks. A strong indicator that investors see a weaker loonie in our future.

The latest update shows a disturbing trend that’s emerging—Canada struggles to attract capital sufficient to offset its debt. A hyper focus on housing is concentrating its economy in just one area. It’s even gotten to the point where its government is borrowing money to buy the mortgage bonds it guarantees. This is like using a payday loan to pay off your credit card—it might work, but there’s a reason moves like this aren’t seen outside of a crisis.

Things aren’t projected to get better for the country. The OECD previously forecast Canada’s addiction to debt, both public and private, will make it the slowest economic growth of any advanced economy for decades. More recently, the latest update from the Bank of Canada (BoC) forecasts the country will underperform the global economic boom. An issue complicated even further by the fact Canada’s population will overperform when it comes to population growth, obfuscating the true erosion in economic growth.