事实上,伦敦金融城的一些头头们似乎开始接受工党政府可能比替代政府更可取的想法。“科尔宾和无协议脱欧一样糟糕吗? 也许不再是了,”花旗银行的克里斯蒂安·舒尔茨 (Christian Schulz) 告诉《每日电讯报》。

当然,金融化不仅仅与银行有关,因此解决这个问题的议程必须比金融部门的改革更加系统化。 取消学费和解决学生债务等政策无疑将有助于英国经济去金融化。

然而,金融化的核心是金融部门(包括“影子银行”),其大脑是国家维护的监管和法律规则体系,这些体系为金融主导经济创造了条件。

除非金融化的心脏和大脑得到解决,否则切断其四肢的尝试可能会被证明是无效的。

本文将基于以下假设探讨去金融化的策略:

a) 金融化,被理解为“金融动机、金融市场、金融参与者和金融机构”的主导地位,目前在全球经济中占据主导地位;

b) 金融化与认真对待社会和环境正义的经济发展方式不相容; 和

c) 下一场危机必然是金融化危机。

建立这个框架后,我们就可以着手解决战略问题——“要做什么?”的问题。

阵地战还是机动战?

可以确定去金融化文献中的两个主要思想流派,我将其称为渐进主义和破裂主义策略。

渐进主义战略试图通过在宏观和微观层面建立新机构的改革来蚕食金融化,这些机构可以随着时间的推移发展成为商业银行的替代品,同时引入监管变革,限制但不破坏金融在关键方面的影响 经济,例如住房和教育。

渐进主义政策方法包括基于国有投资银行的雄心勃勃的公共基础设施投资计划,支持建立工人合作社以及旨在限制金融征用和租金提取的土地和住房政策,包括给予英格兰银行职权 以抑制房价上涨。

经济学家、影子财政大臣约翰·麦克唐纳 (John McDonnell) 的前顾问詹姆斯·米德威 (James Meadway) 提倡一种渐进主义战略,认为“要转变金融,我们需要一个类似于拆除炸弹的缓慢、有条不紊的过程——而不是进一步爆炸。”

他继续说道:“这将意味着对我们的经济进行‘结构性改革’——建立新的机构来提供投资,例如区域开发银行;改变生产性资产的所有权和控制权,例如通过包容性所有权基金”。

在 2014 年 IPPR 智囊团专门针对去金融化的论文中,马修劳伦斯也提倡基于对可能的变化速度保持类似沉默的结构性改革,认为“大胆的意图必须......与认识到相匹配 变革将通过艰苦的努力实现……逆转金融化将不是一件容易或迅速的事情”。

劳伦斯的提议确实与金融部门具体相关,主张英格兰银行在监督和指导信贷创造方面的新任务,新的监管机构,包括金融产品委员会,以评估新的金融产品和英国未来基金,该基金将掠夺收益 金融部门建立最终将成为 1000 亿英镑的主权财富基金,用于长期、可持续的公共投资。

破裂主义战略认为,渐进式改革永远不会在围绕金融部门利益设计的体系中取得进展。 即使渐进式变革确实取得了进展,除非金融的权力基础被剥夺,否则改革很可能会在未来再次被推翻。 相反,破裂主义者提倡对金融部门进行全面攻势。 政策方法包括银行业国有化、债务减记/注销和资本/信贷控制。

SOAS 经济学家、《Profiting Without Producing》一书的作者科斯塔斯·拉帕维萨斯 (Costas Lapavitsas) 是破裂主义战略的倡导者,他认为“没有明确的监管变革路径来应对金融化”。

根据 Lapavitsas 的说法,“如果有必要对金融采取更多的干预主义态度,而不仅仅是建立监管框架,那么应该直接考虑金融机构的产权......将金融作为一个系统来控制将会获得不同的肤色,如果 系统地重新引入了公有制和对银行的控制权。”

根据 Lapavitsas 的说法,“如果有必要对金融采取更多的干预主义态度,而不仅仅是建立监管框架,那么应该直接考虑金融机构的产权......将金融作为一个系统来控制将会获得不同的肤色,如果 系统地重新引入了公有制和对银行的控制权。”

他继续说道:“原则上,公开管理流向家庭和非金融企业的信贷以实现社会既定目标并消除金融征用没有内在困难。”

金斯顿大学经济学家史蒂夫·基恩 (Steve Keen) 在“我们能否避免另一场金融危机?”中以不同的方式指出,解决金融化问题的“政府间接行动”很可能无法将私人债务降至 GDP 水平,并以日本为例 自 1990 年代初开始长达四分之一个多世纪的长期停滞以来,几乎每年公共支出占 GDP 的比重都在增加,但私人债务水平仍停留在 GDP 的 165% 左右(与英国相似)。

基恩写道:“如果市场或间接政府行动都不可能充分减少私人债务,那么唯一的选择要么是直接减少私人债务,要么是增加货币供应以间接减轻债务负担。”

Keen 提出将私人债务水平降至 GDP 的 100% 以下以确保金融稳定的理由,并主张注销债务和/或一种他称之为“现代债务禧年”的直升机撒钱形式。 当局将在此处“将资金直接注入所有私人银行账户,但要求其首先用于偿还债务”。

虽然渐进主义和破裂主义的方法有真正和重要的区别,但从政治战略的角度来看,它们在根本上并不矛盾。 如果我们将政治理解为“可能性的艺术”,其中时间为王,则渐进式和中断式方法都各有其用。 关键是要理解金融主导的增长和危机的明斯基周期,以及政治战略必须如何适应危机的具体阶段。

在金融主导的增长时期,渐进式改革可以帮助尽可能地在“靠财富生活的人和靠工作生活的人”之间重新平衡权力,正如经济学家格蕾丝布莱克利所说,理解政治条件 因为金融化的致命一击尚不存在。

除了上述提出的一些渐进式改革外,政府还应支持出现抵制金融资本的有机形式,包括债务人工会、租户工会和更强大的工作场所组织。 它还应该利用财政和货币政策,使工资通胀始终高于资产通胀,随着时间的推移侵蚀债务价值。

这一时期的另一个关键作用是建立一个去金融化的选举联盟,通过为相当多样化的人口统计数据提供明确的激励措施并在去金融化的英国中占有一席之地,类似于撒切尔的住房改革如何为托利党建立新的人口结构 政治。

当金融体系不可避免地崩溃时,“反向撒切尔主义”可以为即将到来的关键战役打下基础。 John McDonnell 提出的私人租户购买权政策的提议是反向撒切尔主义的一个例子,可以通过区域投资银行来协调,以削减银行业,并为那些有兴趣的人提供额外的激励。 愿意与他们所在街区的其他以前的私人租户一起组成合作住房实体。

在金融危机时期,政治环境会发生翻天覆地的变化。 渐进主义方法不仅有局限性——它对金融化的捍卫者也很有用,只要国家采取行动保护他们的切身利益,他们就会很乐意在短期内让步。 国家行动在危机期间变得不可避免:唯一的问题是它采取什么形式; 国家是否采取行动支持该系统或解构它。 在这一刻,破裂主义战略对于解决危机和作为建立新经济秩序的桥梁变得至关重要。

我们可以通过(误)使用葛兰西阵地战和机动战的战略二分法来理解这种双重战略方法。 阵地战被理解为影响力之争; 而机动战是争夺控制权。

因此,阵地战与债务推动的增长阶段有关,机动战与增长周期不可避免地崩溃的时刻有关。 危机阶段将是本文其余部分的重点。

危机应对策略:拆除炸弹,还是对恶性疾病进行手术?

了解 2008 年崩溃的“第一响应者”的心理至关重要,根据亚当·图兹 (Adam Tooze) 在他关于大萧条的不朽历史“崩溃”中的说法,这就是美国响应的关键人物如何看待自己 :

“这些比喻……将危机应对团队定位为面临迫在眉睫的紧急情况的第一响应者。 他们把我们,他们的听众,放在他们身边。 谁不会支持试图将家庭汽车停在桥上的父亲般的本·伯南克,或者 [蒂莫西] 盖特纳的英勇拆弹小组? 当我们焦急地看着我们的英雄努力将我们从灾难中拯救出来时,政治被搁置一旁。 没有时间问为什么会这样。 我们荣辱与共'。 但正是从这一断言开始,危机的政治经济学开始了。 2008 年秋天需要挽救的是哪个系统?谁受到了伤害? 谁被包括在需要保护的人的圈子里? 谁不是?

Tooze 表示,这种危机应对措施“摆脱了”导致危机的金融化结构性问题,以便“绝对优先考虑拯救金融体系”,这“影响了随后的一切”。

在 2008 年金融危机席卷世界经济时,经合组织发表了一篇关于危机应对策略的论文,正是急救人员的心理为他们提供了信息。 Blundell-Wignall、Atkinson 和 Se-Hoon 总结道:“过去偿付能力危机的基本教训是,始终需要三个步骤:

1. 在危机期间为所有相关存款投保,以防止银行挤兑。

2. 从银行资产负债表中剔除“不良资产”。

3. 对资产清理后的银行进行资本重组。

作者发现,在清理“不良资产”方面,国家始终是关键,而不是市场机制。 为什么?

“原因是因为只有公共部门才能发行无风险资产,并在危机中将其换成风险资产,这在流动性受阻、不确定性普遍存在以及养老金等自然持有人罢工的情况下至关重要 基金、共同基金、保险公司、主权财富基金等。”

经合组织承认,私营部门参与者无力解决自己造成的危机,而且金融部门不良资产的系统性风险太大,无法让他们碰壁。 但是,在国家以亏损为基础进行干预以清理银行的不良资产之后会发生什么?

“很久以后,在退出策略阶段,可以出售公共部门资产:逐渐将它们从公共资产负债表中移除,交给更多的自然持有者,如养老基金、主权财富基金、保险公司和其他投资者。 根据资产的定价以及流程的处理方式,纳税人最终可以从救助计划的成本中弥补部分损失。”

这就是救助经济学——社会主义为富人服务、资本主义为穷人服务的缩影。 公共部门从银行吸收不良资产,然后在这些资产再次成为有吸引力的资产时,以亏本的方式将其出售给私人投资者。 政府的债务水平更高,银行的资产负债表更健康,私人投资者的资产以低价收购。 与此同时,“不良资产”等式的另一端——家庭和企业——得不到救助,失去家园或不得不关闭企业。

民族国家在 2008 年以不同的方式和不同的速度采取了广泛的做法。在一些国家,国家将银行资产国有化或部分国有化,在其他国家,资产被拍卖给投资者——但几乎总是为了 以捍卫和维护金融化的方式摆脱危机。

去金融化危机应对必须具有盖特纳和伯南克隐喻的紧迫性,而不是被视为来自外部威胁的紧急情况,如爆炸装置,它必须被描述为已经达到紧急情况的内生发展 ,例如导致心脏骤停且现在需要手术的恶性疾病,或者吸毒过量且需要重大干预的瘾君子。

这样,危机应对就与长期战略联系起来:手术为医生进行化疗和其他治疗来修复患者铺平了道路; 拯救吸毒者需要紧急治疗,然后是长期的康复计划,从根本上改变这个人的生活方式。

这在政策方面的广泛含义是什么? 下表从概念上区分了经合组织提出的危机应对策略和左翼追求的去金融化议程。

屏幕截图 2019-10-10 at 13.32.34.png

正如经合组织概述了其危机应对战略的三个阶段或步骤,左翼战略也必须按以下方式分阶段进行:

a) 解决中短期危机; 和

b) 决定性地转向长期去金融化计划。

没有足够的空间来彻底讨论这种方法的详细政策影响(无论如何需要进一步的研究和政策制定),但去金融化危机应对战略所需的步骤可能如下所示:

第 1 步:系统地国有化,而不是逐案国有化。 从对整个英国经济构成系统性风险的机构开始,目标应该是最终将所有信贷创造纳入公共控制。 这是危机应对和去金融化之间的关键联系——通过将信贷创造纳入公有制,可以控制经济投资的速度和方向。

第 2 步:确保对金融部门的信心。 保证所有存款。 必要时注入流动性。

第 3 步:引入资本管制。 防止资本流出该国对于控制金融市场至关重要。

第 4 步:对信贷组合进行系统评估,包括一项重大债务减记和注销计划,以减少私人债务对 GDP 的负担。 保证不会因违约而收回房屋或商业财产。 探索出售一些外国资产以减少国际风险的可能性。

第 5 步:根据新的社会目标标准重新设计财务。 重写法规以消除对冲基金和私募股权公司的金融没收; 转变养老基金投资标准并建立透明的会计惯例; 编写新的税法以防止避税; 改革公司法中的“股东价值”; ETC。

第六步:为了大多数人的利益解决危机。 确保充分就业的巨额财政刺激; 改善以前大量金融化的普遍服务(例如教育、公共交通、住房)以降低生活成本的计划。

去金融化的障碍

上述去金融化危机应对策略将面临巨大障碍。

在经济意义上,最重要的挑战将是国际金融市场对英国汇率施加的压力。 这对国内银行业的外债负债来说尤其具有挑战性; 具体来说,获得美元流动性。 美联储在 2008 年金融危机期间作为“全球最后贷款人”的角色在当时鲜为人知,但后来发现它发挥了绝对的作用,“改变了我们想象中的金融体系与金融体系之间的关系” 国家货币”,根据 Tooze 的说法。

正如托尼·诺菲尔德 (Tony Norfield) 在《城市》(The City) 中展示的那样,英国拥有独一无二的国际化金融部门。 英国的金融服务出口额占 GDP 的 2% 到 3%,是美国的五六倍,是迄今为止所有主要经济体中对其他国家的贷款和存款总额最大的国家,总额巨大 英国银行业的 16.7%。 这还不包括全球范围内英国控制的一系列避税天堂。 因此,这带来的主要挑战之一是如何处理在英国经营且拥有大量英国资产的外资银行。

从政治上讲,上述策略将对英国金融精英构成生死存亡的威胁,他们将动用所有巨大的游说力量来阻止它。 如果金融部门本身被阻止,那么金融化的受益者就会形成一个更广泛的联盟——私募股权公司、养老基金经理、土地所有者、地主、财产所有者——他们可以结成一个集团,目的是解除任何去武装化的武装。 金融化议程。

从制度上讲,要让国家以我们上面描述的方式应对危机将面临巨大挑战,无论是在公务员队伍中国家常任代表与金融精英之间的密切关系方面,还是在术语方面。 国家行为者在领导实现去金融化所需的那种行动方面缺乏经验。

但财政部并不关心金融部门和政府之间的旋转门,而是在 2012 年发布的危机应对审查中辩称,“与其他机构进行更高程度的员工交流”会有所帮助,尽管注意到该组织的 高流动率部分是由于“官员在财政部短期借调或借调后返回其他组织”。 这是对左派将面临的制度挑战深度的一瞥。

如果财政部的制度文化存在问题,那么中央银行的制度独立性可能是致命的。 此处概述的战略将要求英格兰银行与财政部紧密合作,愿意对银行业拥有前所未有的权力,并以与其目前职权范围背道而驰的方式行使这种权力。 英格兰银行的授权来自财政部,但对银行的日常控制不受政府影响。 英格兰银行存在的理由首先是保护金融部门。 目前尚不清楚其职权范围的变化是否足以提供去金融化危机应对策略——央行独立性这个棘手的问题可能不得不直面。

根据当时英国与欧盟的关系,国内层面也可能存在制度性挑战,欧盟层面禁止控制资本的规则可能会成为障碍。

从法律上讲,由于严格的英国财产法,如果该部门全部国有化而不是逐家银行国有化,这里的所有权提案可能会受到挑战,并且可能会受到欧洲人权公约的挑战。 债务重组也有可能在合法财产基础上受到挑战。

在非危机时期,这些障碍的组合可能会使对金融部门所有者的全面正面攻击过于危险,以至于左翼政府无法进行。 但金融的弱点是它的高风险维度,这意味着它需要国家打破治理规范以在危机时期保护它。

金融主导增长的逻辑中存在不稳定性。 在反对银行的群众运动失去整个社会霸权的政治环境中,政府可以处于这样一种境地,去金融化危机应对战略的障碍突然看起来不像维护地位那样令人生畏 现状。

去金融化案例研究:冰岛

试图最终回答上述所有障碍不在本文的范围内——在这方面需要进一步的研究和政策制定。 除了提出问题和建议可能的答案之外,我们还可以看看 2008 年崩盘中为数不多的例子之一,它至少部分反驳了悲观观点,即除了救助经济学别无选择。

Björn Rúnar Guðmundsson 在他对冰岛金融化和金融危机的研究中指出,冰岛以“一系列常规和非常规政策行动”应对 2008 年的崩溃,导致“一定程度的去金融化”。

一项紧急法案将三大银行拆分为一家负责国内业务的新银行和一家负责国际业务的“老”银行。 政府还承诺为所有银行存款提供担保。 然后,引入了资本管制,这意味着“禁止所有资本项目交易,以防止金融资产退出,其中大部分由外国投资者持有”。 资本管制最终持续到 2017 年,“阻碍了金融部门的整体复苏”。

这两项政策是银行业投资组合和活动转型的基础。 所有转移到新银行的贷款都“按公允价值”重新估值。 银行的关注点变成了“债务重组和资产负债表修复”,而“外汇市场、股票市场和债券市场的市场成交量大幅下降”。

其结果是在整个经济领域,尤其是在商业领域,实现了深刻的去杠杆化。 由于系统性的“减记和注销”,公司债务占 GDP 的比例从崩盘前的 300% 以上下降到 2014 年的 80% 以下。 家庭债务下降得更慢,但到 2014 年已降至 2005 年的水平。

事实证明,清理银行资产负债表是非常成功的,即使对于那些“向上重估其投资组合并相应地报告利润”的银行也是如此。 Guðmundsson 发现,通过这种方式,“最初受损的贷款组合在危机后的表现超出了预期。”

结果是冰岛的经济发展模式发生了根本性的变化,“从金融主导型增长转向越来越多的出口主导型增长”。 危机期间克朗在国际上的贬值为出口导向型复苏奠定了基础,该国在 2014 年出现了十多年来的首次经常账户盈余。 经常账户赤字在 2006 年达到顶峰,占 GDP 的 23%。

遵守欧洲经济区 (EEA) 规则的国际政治压力和国内金融政治力量的重新确立导致资本管制在 2017 年结束。随着外债和国际资本流动才慢慢开始重新 -断言,现在说新自由主义模式是否回归还为时过早,但这确实凸显了冰岛部分去金融化的局限性。

虽然冰岛银行业进行了重组,但其用途并未得到充分调整,短期盈利能力仍然是主要驱动力。 尽管如此,冰岛证明,尽管去金融化的障碍非常巨大,但并非不可逾越,尤其是在金融化危机的深度很深的情况下。

结论

一个我们永远不知道答案的有趣的思想实验如下:如果 Jeremy Corbyn 和 John McDonnell 在 2008 年的崩溃中负责,而不是 Gordon Brown 和 Alistair Darling,事情会不会有什么不同?

麦克唐纳当然一直在考虑这个问题。 Richard Barbrook 是病毒式大选游戏“Corbyn Run”背后的“class wargames”组织的创始人,他一直在为影子财政大臣的团队提供有关工党政府危机的战争游戏的建议。

PoliticsHome 报道称:“英镑挤兑、投资者外流以及类似 2008 年袭击全球经济的金融危机是该团队将尝试应对的情景类型。”

很明显,对于社会主义者应该如何在新自由主义经济中利用政府权力,麦克唐纳尤其深思熟虑,他知道他不一定会有很多有机盟友。 在英国工业的大部分领域,没有工人运动可言,在整个西方世界,几乎没有当权的社会主义者可以充当国际盟友。 他甚至不能依靠自己的后座议员。

麦克唐纳的想法似乎是,在这种情况下,生存将是当务之急。 不被财力逼下台,本身就是一种成就。 考虑到这一点,这位影子财政大臣可能会对金融部门越来越容易接受科尔宾领导的工党政府的想法感到满意。

但是,正如未来主义作家阿尔文·托夫勒所说,“如果你没有战略,你就是别人战略的一部分”。 虽然工党觉得纽约市已被消除为对该党选举前景的政治威胁可能会感到欣慰,但财政部门也将寻求制服科尔宾和麦克唐纳可能威胁其权力的任何激进改革。

在金融化时代,如果左翼政府不向金融势力发起进攻,它真的能指望未来某个时候不付出代价吗? 此外,在危机重重的金融体系中,金融化的主要矛盾真的能像 2008 年那样被工党政府置之不理吗? 工党政府能否现实地面对我们时代的紧迫挑战——包括但不限于气候崩溃、不平等和贫困、人口危机和自动化——同时让金融继续为英国经济提供支持?

这些问题都没有简单的答案,但回避它们只会让问题越积越多。 “要做什么?”关于金融的问题需要紧急关注。

De-financialising the economy: what is to be done?

https://www.opendemocracy.net/en/oureconomy/de-financialising-economy-what-be-done/

Tackling the power of finance head on is essential if we are to address the urgent challenges of our time. But it won't be easy.

Image: Matt Crossick/PA Archive/PA Images

Image: Matt Crossick/PA Archive/PA Images

This essay is part of ourEconomy's 'Preparing for the next crisis' series.

The Labour Party’s 2019 annual conference was a cornucopia of radical policy announcements, as the party prepares to fight an imminent general election. But one area where the conference was noticeably quiet was the centre of Britain’s financialisation regime: the banking sector.

Proposals for re-purposing majority-state owned RBS remain on the table, but there is little by way of concrete reform plans – regulatory or otherwise – for challenging the power of private finance as a whole. The recent establishment of a “City Surgery” indicates a growing desire to reassure banks about the party’s plans in office.

Indeed, some head honchos in the City of London appear to be coming round to the idea that a Labour government may be preferable to the alternative.

“Is Corbyn as bad as no-deal? Perhaps no longer,” Christian Schulz, at Citi bank, told The Telegraph.

Of course, financialisation is not simply about the banks, and thus an agenda to tackle it has to be much more systematic than reform of the financial sector. Policies such as scrapping tuition fees and tackling student debt would undoubtedly contribute to de-financialising the UK economy.

However, the beating heart of financialisation is the financial sector (including ‘shadow banking’), and its brain is the system of regulatory and legal rules upheld by the state which re-produce the conditions for finance to dominate the economy.

Unless the heart and brain of financialisation is tackled, attempts to cut off its limbs will likely prove ineffective.

This essay will explore strategies for de-financialisation, based on the following assumptions:

a) Financialisation, understood as the dominance of “financial motives, financial markets, financial actors and financial institutions”, is currently hegemonic in the global economy;

b) Financialisation is incompatible with an approach to economic development which takes social and environmental justice seriously; and

c) The next crisis will invariably be a crisis of financialisation.

With this framework established, we can proceed to address the question of strategy – the ‘what is to be done?’ question.

War of position, or war of manoeuvre?

Two main strands of thought within de-financialisation literature can be identified, which I will call incrementalist and rupturalist strategies.

The incrementalist strategy seeks to eat away at financialisation through reforms which build new institutions at the macro and micro level which can over-time develop into an alternative to the commercial banks, while introducing regulatory changes which limit, without breaking, finance’s reach into key aspects of the economy, such as housing and education.

Incrementalist policy approaches include an ambitious public infrastructure investment plan based on state-owned investment banks, supporting the establishment of worker co-operatives and policies on land and housing which seek to restrict financial expropriation and rental extraction, including giving the Bank of England a remit to restrict house price inflation.

James Meadway, economist and former advisor to shadow Chancellor John McDonnell, has advocated an incrementalist strategy, arguing that “to transform finance, we need a slow, methodical process akin to defusing a bomb — not a further explosion.”

He goes on: "It will mean ‘structural reforms’ to our economy — building new institutions to deliver investment, like the regional development banks; changing the ownership and control of productive assets, for example through the Inclusive Ownership Funds”.

In a paper specifically on de-financialisation for the IPPR think-tank in 2014, Mathew Lawrence also advocated structural reforms based on a similar reticence about the speed of change which was possible, arguing “boldness of intent must…be matched with a recognition that change will be painstakingly achieved…Reversing financialisation will not be an easy or swift endeavour”.

Lawrence’s proposals do pertain to the financial sector specifically, arguing for a new Bank of England mandate on monitoring and guiding credit creation, new regulatory institutions including a Financial Product Board to assess new financial products and a British Future Fund which would skim off the proceeds of the financial sector to build up to what eventually would be a £100 billion sovereign wealth fund for long-term, sustainable public investments.

The rupturalist strategy argues that incremental reforms will never make headway against a system that has been designed around the interests of the financial sector. Even if incremental changes did make progress, unless finance’s base of power is taken away from it, reforms are likely to be over-turned again further down the line. The rupturalists instead advocate a full-frontal offensive on the financial sector. Policy approaches include nationalisation of the banking sector, debt write-downs/write off’s and capital/credit controls.

Costas Lapavitsas, SOAS economist and author of ‘Profiting Without Producing’, is an advocate of a rupturalist strategy, arguing that “there are no clear paths of regulatory change to confront financialisation”.

According to Lapavitsas, “If it is necessary to adopt a more interventionist attitude toward finance than merely setting a regulatory framework, then property rights over financial institutions ought to be considered directly... Controlling finance as a system would acquire a different complexion, if public ownership and control over banks were re-introduced systematically.”

He goes on: “In principle, there would be no intrinsic difficulty in publicly managing the flow of credit to households and non-financial enterprises to achieve socially set objectives as well as to eliminate financial expropriation.”

In a different way, Kingston University economist Steve Keen argues in ‘Can we avoid another financial crisis?’ that “indirect government action” to address financialisation is likely to fail to bring down private debt to GDP levels, citing the example of Japan where there has been an increase in public spending to GDP for almost every year since it’s more than quarter of a century long stagnation began in the early 1990’s, but private debt levels remain stuck at around 165 per cent of GDP (similar to the UK’s).

“If neither market nor indirect government action is likely to reduce private debt sufficiently, the only options are either a direct reduction of private debt, or an increase in the money supply that indirectly reduces the debt burden,” Keen writes.

Keen makes the case for private debt levels to be reduced to significantly below 100 per cent of GDP to ensure financial stability, and argues for debt-write off’s and/or a form of helicopter money which he calls a ‘modern debt jubilee’. This is where authorities would make “a direct injection of money into all private bank accounts, but require that its first use is to pay down debt”.

While incrementalist and rupturalist approaches have genuine and important differences, in political strategy terms they do not be fundamentally at odds with one another. If we understand politics as the ‘art of the possible’, where timing is king, both incremental and ruptural approaches have their place. The key is to understand the Minskyite cycle of finance-led growth and crisis, and how a political strategy must adapt itself to the specific phases of that crisis.

At times of finance-led growth, incremental reforms can help to re-balance power as far as possible between “those who live off wealth and those who live off work”, as economist Grace Blakeley puts it, with the understanding that the political conditions for a knock-out blow of financialisation do not yet exist.

As well as some of the incremental reforms proposed above, government should support the emergence of organic forms of resistance to finance capital, including debtors unions, tenants unions and stronger workplace organisation. It should also utilise fiscal and monetary policy in such a way that wage inflation is always higher than that of assets, eroding the value of debts over time.

Another key role in this period is to build an electoral coalition for de-financialisation, by providing quite diverse demographics with clear incentives and a stake in a de-financialised Britain, in a similar way to how Thatcher’s housing reforms built a new demographic for Tory politics.

A ‘reverse Thatcherism’ can act to prepare the ground for the key battles to come when the financial system inevitably implodes. The proposal for a right-to-buy policy for private tenants, floated by John McDonnell, is one example of reverse Thatcherism, which could be co-ordinated through regional investment banks to cut out the banking sector, with additional incentives for those who are willing to club together with other formerly private tenants in their block to form co-operative housing entities.

At times of financial crisis, the political conditions alter utterly. An incrementalist approach is not only limited – it is also useful for the defenders of financialisation, who become quite happy to concede some ground in the short-term, as long as the state acts to protect their vital interests. State action becomes inevitable during a crisis: the only question is what form it takes; whether the state acts to prop up that system or de-construct it. In this moment, a rupturalist strategy becomes essential in both resolving the crisis, and as a bridge to establishing a new economic order.

We can understand this dual strategic approach by (mis)using the Gramscian strategic dichotomy of war of position and war of manoeuvre. The war of position is understood as the struggle for influence; whereas the war of manoeuvre is the struggle for control.

The war of position therefore pertains to the phase of debt-fuelled growth, and the war of manoeuvre to the moment when that growth cycle inevitably crashes. It is the crisis phase that will be the focus of the rest of this essay.

Crisis response strategies: unpicking a bomb, or performing surgery on a malignant disease?

It is vital to understand the psychology which informed the “first responders” of the 2008 crash, which is how the key figures of the United States’ response thought of themselves according to Adam Tooze in his monumental history of the Great Recession, ‘Crashed’:

“The metaphors…position the crisis-fighting team as first responders facing a compelling emergency. And they place us, their audience, by their side. Who would not root for the fatherly Ben Bernanke trying to keep the family car on the bridge, or [Timothy] Geithner’s heroic bomb disposal team? Politics is set aside as we anxiously watch our heroes struggle to rescue us from disaster. There is no time to ask why this happening. We are 'all in this together'. But it is precisely with that assertion that a political economy of the crisis begins. Which system was it that needed to be saved in the autumn of 2008. Who was being hurt? Who was included in the circle of those who needed to be protected? And who was not?”

This crisis response took “off the table” the structural problems of financialisation which brought the crisis to being, in order to “give absolute priority to saving the financial system” which “shaped everything else that followed”, according to Tooze.

It was the psychology of first responders that informed an OECD paper on crisis response strategies published as the 2008 financial crash was ripping through the world economy. Blundell-Wignall, Atkinson and Se-Hoon concluded that: “The basic lesson of the past solvency crises is that three steps are always required:

1. Insure all relevant deposits during the crisis to prevent runs on banks.

2. Remove the ‘bad assets’ from the balance sheet of banks.

3. Recapitalise the asset-cleansed banks.”

The state is always crucial in clearing out ‘bad assets’, rather than market mechanisms, the authors found. Why?

“The reason is because only the public sector can issue risk-free assets and exchange them for risky assets in a crisis, which is critical when liquidity is jammed and there is widespread uncertainty and a buyers strike on the part of natural holders such as pension funds, mutual funds, insurance companies, sovereign wealth funds and the like.”

The OECD accepts that private sector actors are incapable of resolving a crisis of their own making, and that the systemic risk of the financial sector’s bad assets is too great to allow them to go to the wall. But what then happens after the state intervenes on a loss-making basis to cleanse banks of their bad assets?

“Much later, in the exit strategy phase, the public sector assets can be sold: gradually removing them from the public balance sheet towards more natural holders such as pension funds, sovereign wealth funds, insurance companies and other investors. Depending on the pricing of assets, and how the process is handled, the taxpayer could eventually recoup some of the losses from the costs of the rescue packages.”

This is bailout economics – the epitome of socialism for the rich, capitalism for the poor. The public sector takes on bad assets from banks and then sells them to private investors at a loss to the public purse when they become attractive assets again. The government is then left with a higher level of debt, the banks are left with a healthier balance sheet, and private investors are left with assets acquired on the cheap. Meanwhile, those on the other side of the ‘bad assets’ equation – households and businesses – receive no bailout, and lose their home or have to wind up their enterprise.

In different ways and at different speeds, this was broadly the approach that nation-states pursued in 2008. In some countries the state nationalised or part-nationalised bank assets, in others assets were auctioned off to investors – but almost always with the aim of exiting the crisis in such a way as to defend and uphold financialisation.

A de-financialisation crisis response must have the urgency of Geithner and Bernanke’s metaphors, but rather than being considered as an emergency from an exogenous threat, like an explosive device, it must be depicted as an endogenous development which has reached the point of an emergency, like a malignant disease which has caused a cardiac arrest and now requires surgery, or an addict who has over-dosed and needs a major intervention.

In this way, the crisis response is connected to the long-term strategy: surgery paves the way for the doctor to conduct chemotherapy and other treatments to fix the patient; saving the addict requires emergency treatment followed by a long-term recuperation plan which fundamentally changes the person’s way of life.

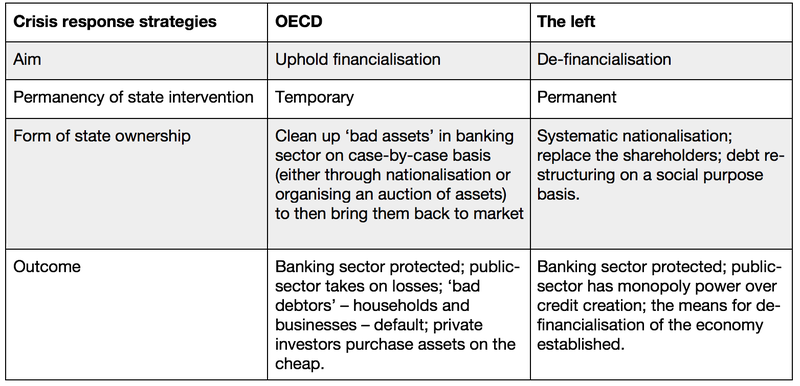

What does this mean broadly in policy terms? The following table conceptually separates out crisis response strategies between that proposed by the OECD and that of a de-financialisation agenda pursued by the left.

Just as the OECD outline three phases, or steps, to their crisis response strategy, the left’s strategy must also be phased in a way which:

a) Resolves the crisis in the short to medium term; and

b) Makes a decisive shift towards the long-term de-financialisation plan.

There is insufficient space to thoroughly debate the detailed policy implications of such an approach (which in any case requires further research and policy development), but the steps which are required for a de-financialisation crisis response strategy may look like the following:

Step 1: Nationalise systematically, not on a case-by-case basis. Starting with the institutions where the risk to the UK economy as a whole is systemic, the aim should be to eventually bring all credit creation into public control. This is the key link between crisis response and de-financialisation – by taking credit creation into public ownership, the rate and direction of investment in the economy can be controlled.

Step 2: Ensure confidence in the financial sector. Guarantee all deposits. Inject liquidity where necessary.

Step 3: Introduce capital controls. Preventing capital flows out of the country will be essential in keeping financial markets in check.

Step 4: Implement a systematic evaluation of the credit portfolio, including a plan for a major debt write-down’s and write-off’s to reduce the private debt to GDP burden. Guarantee no repossession of homes or business properties from defaults. Explore the potential for a sale of some foreign assets to reduce international exposure.

Step 5: Re-design finance with new social purpose criteria. Re-write regulations to eliminate financial expropriation from hedge funds and private equity firms; transform pension fund investment criteria and create transparent accounting practices; write a new tax code to prevent avoidance; reform ‘shareholder value’ in company law; etc.

Step 6: Resolve the crisis in the interests of the majority. A huge fiscal stimulus to ensure full employment; plans for improving provision of universal services that were previously heavily financialised (e.g. education, public transport, housing) to reduce the cost of living.

The barriers to de-financialisation

The de-financialisation crisis response strategy outlined above would face formidable barriers.

In an economic sense, the most important challenge would be the pressure placed on the UK’s exchange rate by international financial markets. This will be particularly challenging in relation to the domestic banking sector’s foreign debt liabilities; specifically, access to dollar liquidity. The role of the Federal Reserve as “global lender of last resort” during the 2008 crash was barely known about at the time, but has since been revealed to have been absolutely instrumental, “transforming what we imagine to be the relationship between financial systems and national currencies”, according to Tooze.

Britain has a financial sector which is uniquely internationalised, as Tony Norfield shows in ‘The City’. UK financial services exports are worth 2 to 3% of GDP, a figure five or six times higher than for the US, and it has by far the largest total loans to, and deposits from, other countries of any major economy, totalling a massive 16.7% of UK banking. And that’s not including the string of UK controlled tax havens around the globe. One of the key challenges this presents is therefore how to deal with foreign-owned banks operating in the UK with substantial UK-based assets.

Politically, the strategy outlined above would be an existential threat to UK financial elites, who would muster all of their enormous lobbying power to stop it. If the financial sector itself is held off, there is then a broader coalition of benefactors from financialisation – private equity firms, pension fund managers, landowners, landlords, property owners – who could be forged into a bloc with the aim of disarming any de-financialisation agenda.

Institutionally, there will be a massive challenge in getting the state to respond to crisis in the way we’ve described above, both in terms of the close relationships between the permanent representatives of the state in the civil service and financial elites, and in terms of the lack of experience of state actors in leading the sort of actions that would be necessary to make de-financialisation happen.

But far from being concerned with a revolving door between the financial sector and government, the Treasury argued in a review of its crisis response published in 2012 that a “higher degree of staff exchange with other institutions” would have been helpful, despite noting the organisation’s high turnover was partly due to “officials returning to other organisations after short spells on loan or secondment at the Treasury”. This is a glimpse into the depths of the institutional challenge the left would face.

If the institutional culture of the Treasury would be problematic, the institutional independence of the central bank would potentially be deadly. The strategy outlined here would require the Bank of England to be working in lock-step with the Treasury, willing to take unprecedented power over the banking sector, and wield that power in a way that is anathema to its present remit. The Bank of England gets its mandate from the Treasury, but control over the bank on a day-to-day level is independent from government influence. The Bank of England’s raison d’être is to protect the financial sector first and foremost. It’s not clear that a change in its remit would be sufficient to deliver a de-financialisation crisis response strategy – the vexed question of central bank independence may have to be confronted head on.

There would also potentially be an institutional challenge at the intra-national level, depending on Britain’s relationship with the EU at that time, with rules preventing controls on capital at EU level potentially acting as an impediment.

Legally, the ownership proposals here could come under challenge if the sector is nationalised in its entirety, rather than on a failed bank-by-bank basis, due to stringent UK property laws, and potentially a challenge at the European Convention of Human Rights. There is also the potential for debt restructuring to be challenged on a legal property basis.

In non-crisis times, this combination of barriers would likely make a full-frontal attack on the proprietors of the financial sector too dangerous to pursue for a left government. But the weakness of finance is its high-risk dimension, which means that it needs the state to break with governing norms to protect it in times of crisis.

Instability is built into the logic of finance-led growth. In a political environment of a mass movement against the banks where it loses hegemony in society as a whole, the government can be put in a position where the barriers to a de-financialisation crisis response strategy suddenly do not look as daunting as upholding the status quo.

A case study in de-financialisation: Iceland

It’s not within the scope of this essay to attempt to answer conclusively all of the barriers identified above – further research and policy development is required on that front. Beyond posing questions and suggesting possible answers, we can look to one of the few examples from the 2008 crash which at least partially disproves the pessimistic view that there is no alternative to bailout economics.

Iceland responded to the 2008 crash with “a series of conventional and unconventional policy actions” which led to “a certain degree of de-financialisation”, According to Björn Rúnar Guðmundsson, in his study of financialisation and financial crisis in Iceland.

An Emergency Act broke up the three big banks into a new bank for domestic activities and an “old’ bank for international activities. The government also pledged to guarantee all bank deposits. Then, capital controls were introduced that meant “all capital account transactions were prohibited in order to prevent the exit of financial assets, most of which were held by foreign investors”. Capital controls ended up lasting until 2017, “impeding general financial sector recovery”.

These two policies were the foundations for a transformation in banking portfolios and activity. All loans transferred to the new banks were-revalued “on a fair value basis”. The focus of the banks became about “debt restructuring and balance sheet repair” while “market turnover in the foreign exchange market, the equity market, and the bond market plummeted”.

The outcome was a profound de-leveraging across the economy, especially in the business sector. Corporate debt fell from over 300 per cent of GDP just before the crash to under 80 per cent by 2014 as a result of systematic “write-downs and write-off’s”. Household debt fell more slowly, but by 2014 it had reduced to 2005 levels.

The clean-up of bank balance sheets has proved enormously successful, even for the banks, which have “revalued their portfolios upwards and report profits accordingly”. In this way, Guðmundsson finds, “the originally impaired loan portfolios have over performed relative to expectations in the wake of the crisis.”

The outcome is Iceland’s economic development model has fundamentally changed, with “a shift away from financial-led towards increasingly export-led growth”. The drop in the value of the Krona internationally during the crisis provided the basis for an export-led recovery, with the country recording a current account surplus in 2014 for the first time in over a decade. The current account deficit peaked in 2006 at 23 per cent of GDP.

The combination of international political pressure to comply with European Economic Area (EEA) rules and a re-assertion of the domestic political power of finance led to the end of capital controls in 2017. With foreign debts and international capital flows only slowly beginning to re-assert themselves, it’s too soon to say if the neoliberal model is back, but this does highlight the limitations of Iceland’s partial de-financialisation.

While Icelandic banking was re-organised, it was not sufficiently re-purposed, with short-term profitability remaining the key driver. Despite this, Iceland is evidence that while the barriers to de-financialisation are formidable, they are not insurmountable, especially if the depths of the crisis of financialisation is profound.

Conclusion

An interesting thought experiment, which we will never know the answer to, is the following: if Jeremy Corbyn and John McDonnell were in charge during the 2008 crash, rather than Gordon Brown and Alistair Darling, would things have turned out any differently?

McDonnell has certainly been thinking about this. Richard Barbrook, founder of the group ‘class wargames’ which was behind the viral General Election game ‘Corbyn Run’, has been advising the shadow Chancellor’s team on war gaming a crisis in a Labour government.

“A run on the Pound, an exodus of investors and a financial crash like the one that struck the global economy in 2008 are the types of scenarios the team will try to respond to,” PoliticsHome reported.

It’s clear that McDonnell especially is a deep thinker about how socialists should utilise government power in a neoliberal economy, knowing that he will not necessarily have many organic allies. Across large sections of British industry there is no workers movement to speak of, and across the Western world there are few socialists in power to act as international allies. He can’t even rely on his own backbench MPs.

What appears to be McDonnell’s thinking is that, given those circumstances, survival will be the first order of the day. Not to be forced out of office by the power of finance will be an achievement in and of itself. With that in mind, the shadow chancellor may be satisfied with the financial sector’s growing ease towards the idea of a Corbyn-led Labour Government.

But, as the futurist writer Alvin Toffler put it, “if you don’t have a strategy, you’re part of someone else’s strategy”. While it may be comforting for Labour to feel like The City has been neutralised as a political threat to the party’s electoral prospects, finance will also be looking to subdue any radical reforms from Corbyn and McDonnell which could threaten its power.

In the age of financialisation, if a left government does not go on the offensive against the power of finance, can it really expect not to pay the price at some future point down the line? Plus, in a crisis-ridden financial system, can the major contradictions of financialisation really be left unresolved by a Labour Government, à la 2008? And can a Labour government realistically face up to the urgent challenges of our time – including but not limited to climate breakdown, inequality and poverty, a demographic crisis and automation – while allowing finance to remain in the saddle of the British economy?

None of these questions have easy answers, but avoiding them will only see problems accumulate. The ‘what is to be done?’ question about finance needs urgent attention.

Russian aggression is driving Ukrainians into poverty. But the war could also be an opportunity to reset the Ukrainian economy – if only people and politicians could agree how. The danger is that wartime ‘reforms’ could ease a permanent shift to a smaller state – with less regulation and protection for citizens.

Our speakers will help you unpack these issues and explain why support for Ukrainian society is more important than ever.

Read more

Image: Matt Crossick/PA Archive/PA Images

Image: Matt Crossick/PA Archive/PA Images