股市小书生

价值投资先说废话:

我们交流的投资逻辑,相互学习的也只是投资逻辑。虽然我们涉及一些具体的实例,但是目的都是为了阐述其背后的投资逻辑,我认为一个理智成熟的人应该会主动的理解这一点。有些人认为我现在谈股指,加国银行股就是鼓吹在最高价买入股指和加国银行股,我请求这样的人不要阅读我的帖子,因为你没有能力理解我要阐述的投资逻辑,没有必要浪费时间,而且因为你无法正确理解,所以即使我的投资逻辑是“无毒”的,你也会主动的把它变成“有毒”的,因此我再次请求你不要阅读我的帖子。

下面有一个猛牛的帖子,因为他提到了一个我很感兴趣的东西 “红利”,我想谈谈我的一些学习体会。

---------------------------------------------------------------------------------------------------------------

猛牛:

本来看他是俺同一战壕里的战友,要爱护小战友,不批评他,结果他越来越离谱,什么“每个月的15号是大多数加国地产基金交租(发红利)的日子,看着比自己薪水高几倍的现金每月准确无误的到账,是一种享受。”都来了。

就算我“清理门户“ 好了。让地主们见笑了。

见谅!

另外,投资股票的股友,如果你还年轻,千万不要听他忽悠卖分红股票,买分红股票是

钱多或上了岁数的人士保守投资(但比债卷风险大些),属于获得稳定收入的投资范畴。

----------------------------------------------------------------------------------------------------------------

"Do you know the only thing that gives me pleasure? It's to see my dividends coming in."

- John D. Rockefeller

“每个月的十五号是我每个月最高兴的一天,因为那是我每个月收到红利最多的一天。” - 股市小书生

“每个月收到房租的时候是我最开心的一刻。” - 老朽 (朽哥,是这么个意思吧?)

“ The prime purpose of a business corporation is to pay dividends regularly and, presumably, to increase the rate as time goes on.”

— Benjamin Graham, Security Analysis, 1934

加国五大银行在一百多年时间,从不间断向股东支付红利,并且以大于通胀的幅度增加红利,

所以加国银行符合Benjamin Graham对企业的基本定义。

再说几句废话,我学习的是已经被Benjamin Graham带入坟墓的最陈旧的投资基础理论,没有任何的“新玩意”,想追“新玩意”的人,请忽略我的帖子。

下面是一些网络文章摘选:

Dividends are an important form of return to equity investors, and have become one of the most researched topics in capital markets. The popularity of dividend-paying stocks is high, and for good reason: dividends can be a significant contributor to superior long-term investment results.

This general finding has been documented over various timeframes and markets. For example, one study examines the components of total equity returns of US stocks from 1802 to 2002. Over the 200-year period, dividends (plus real growth in dividends) accounted for fully 5.8% of the 7.9% total annualized returni. Another study examines the subject from a global perspective. Researchers at the London Business School found that, from 1900 to 2005, the real return across 17 countries averaged approximately 5%, while the average dividend yield of those countries during the period was 4.5%ii.

The Returns Data

This paper utilizes data from Kenneth French, based on original stock data from the US Stock Database©2014 Center for Research in Security Prices (CRSP), the University of Chicago Booth School of Business and includes all equity securities listed on NYSE, Amex, NASDAQ and NYSE Arca during the time period. We utilized monthly and annual value-weighted total returns of non-dividendpaying

US stocks and five portfolios of dividend-paying stocks from 1928 through 2013. The five dividend-paying portfolios are constructed using quintiles of the dividend-to-price ratio (dividend yield), with quintile 1 representing the lowest-yielding dividend payers and quintile 5 representing the highest. Portfolios were formed and rebalanced annually.

The Long Term

The chart below shows how an investment in each portfolio as of January 1928 would have grown through December 2013, with dividends reinvested. Over the full period, all portfolios of dividend payers outperformed the portfolio of non-dividend payers. Other features are important to highlight. Generally, higher dividend-yielding quintiles outperformed lower-yielding quintiles. As shown in Table 1, the volatility of the dividend payers, as measured by annualized standard deviation, was ignificantly lower than that of the non-payers. This is evident in the relatively higher Sharpe ratios of the dividend payers.

20-Year Horizons

Many investors have an investment horizon shorter than our sample illustrates. Furthermore, within the past 86 years, markets have gone through several boom and bust cycles. No doubt, the timing of investment can be critical to an investor’s ultimate fortunes. In this section, we measure how dividend-paying stocks have performed across various holding periods. Arbitrarily, we have chosen to measure performance across 20-year periods, a realistic time frame for most long-term investors.

In the full dataset there have been 67 periods of 20 consecutive calendar years. Table 2 on the following page shows how the six portfolios stack up on annualized returns and standard deviations over the 20-year periods. Similar to the full 86-year sample, we find a direct relationship between dividend yield and total return. And again, volatility for dividend-paying portfolios was lower than that of non-payers.

Performance in Down Markets

To identify “down markets,” we utilized monthly data from a CRSP dataset that contained a market” return from January 1928 through December 2013. We believe this series is the best available representation of a broad U.S. market return, and used it to determine all periods in which the market declined a cumulative 10% or more (a common definition for a market correction) in onsecutive negative months. We then calculated the cumulative returns of the six portfolios for the same months the market was in a correction. There were 46 market corrections during the period (11 corrections occurred during the past 20 years). Of these 46 periods, duration ranged from one month to seven consecutive months of negative monthly returns. Because of the wide range of severities

of these drawdowns—ranging from -10% to -42%—we’ve summarized the results in Table 5.

These findings summarize the downside protection that dividend payers have historically provided during down markets. The relative advantage over non-dividend payers was larger in more moderate drawdowns. But even during severe drawdowns each quintile of dividend payers substantially outperformed non-dividend payers. In another study, the Wall Street Journal cited market performance during 1981-1982, 1990, 2000-2002, and 2008, finding that dividend payers as a whole outperformed non-payers during the market routs of those yearsiii. These findings offer evidence to support the claim that the results generated from the full 86-year sample are in accordance with modern market history. Downside protection is meaningful to most investors due mainly to the speed and intensity of corrections (28 out of the 46 corrections in our sample were finished in three months or less). Many institutions are not able to reallocate a portfolio quickly in the midst of a downturn due to size and rigidity of decision-making processes. Most non-professional investors may lack the real-time market knowledge or the necessary tools to act quickly. A strong case can thus be made for maintaining a strategic allocation to dividend-paying stocks, if only on the grounds of risk management.

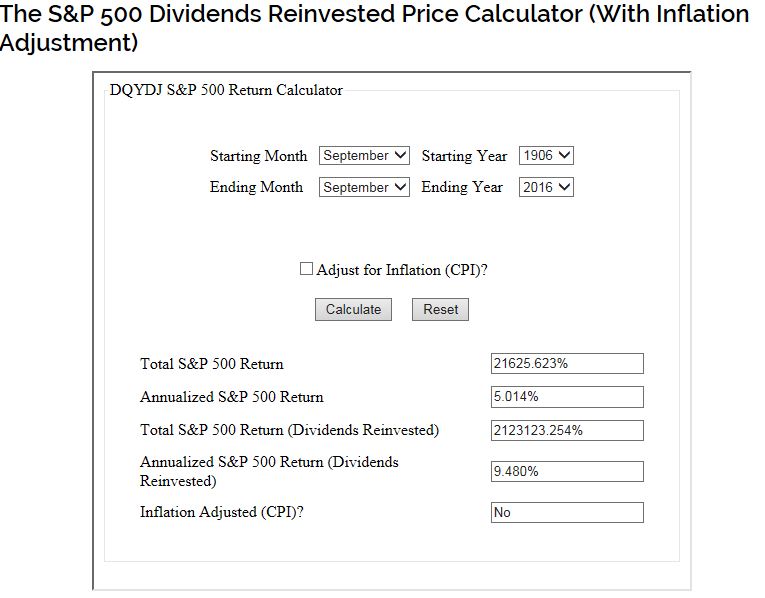

过去一百年,美国市场的整体回报中红利和红利复利再投资占99%。

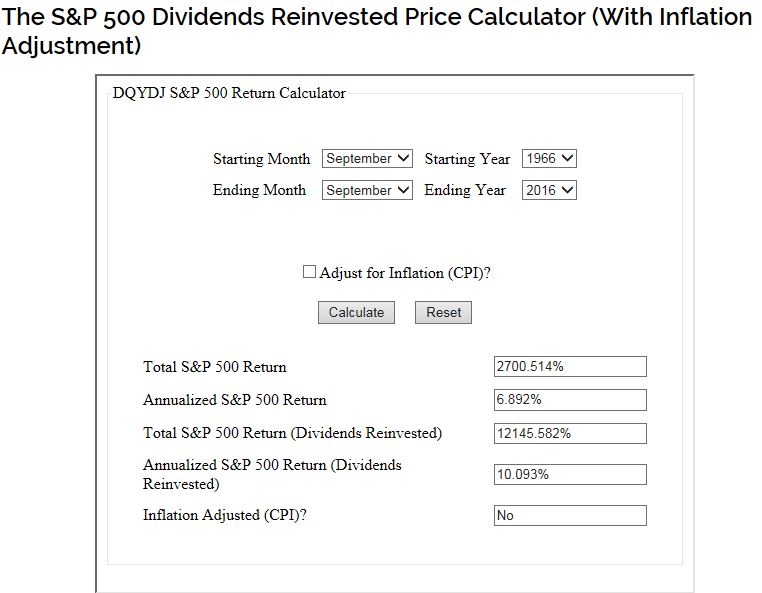

过去五十年,美国市场的整体回报中红利和红利复利再投资占78%。

过去二十年,美国市场的整体回报中红利和红利复利再投资占45%。

过去四十年,TD的整体回报中红利和红利复利再投入占78%。

在长期投资中, 如果你忽略红利和红利的复利再投入,你就忽略了市场整体回报中的绝大多数利润。当你的整体投资组合偏向于非红利股,你选择了更高难度的投资方式,而你的回报可能是更低。当你的整体投资组合偏向于红利股,你选择了最低难度的投资方式,而你的回报可能是最高的。这里说的是一个基本理论概念。

所以对像猛牛一样,在股市中选择高难度,低回报的投资者,我要对他们说:

“兄弟,您辛苦,您受累。挑战高难度,悠着点,别散了腰。”