正文

WEDNESDAY, SEPTEMBER 29, 2010

Strong Stocks or Debilitated Dollar?

By MICHAEL KAHN

Stocks are up only in terms of a declining dollar. In real terms, relative to gold, stocks have gone nowhere.

THE STOCK MARKET IS ON track to crush September\'s evil reputation as the worst month of the year. But at the same time, gold is setting new record highs almost daily while the U.S. dollar sinks steadily.

Something is wrong with this picture, which means it\'s no time to stop paying attention.

Any chart watcher knows that arguing with price action as it unfolds results in frustration at best and losses at worst. Most of the time, we have to swallow bad news, such as falling consumer confidence, and follow the market higher.

Technically, equities indeed are resilient and seemingly every other day shake off morning weakness to rebound by the close. Stocks reaching new 52-week highs are plentiful while stocks at the other end are scarce. And for all the fuss that many (including me) made of moving average death crosses in July, the major indexes are on track for the opposite signal --golden crosses-- in which the 50-day moving average breaks above the 200-day moving average.

So what\'s the problem? Basically, negative factors don\'t matter until they do. Only retrospectively do their importance reveal themselves.

The bond market continues to voice its displeasure with the economy. When risk assets were in demand in July, the two-year Treasury note yield fell in protest. When risk assets fell in August, the two-year yield fell to record lows as money flowed to safety. And again this month, when investors flocked to stocks and commodities, the two-year yield dipped to yet another record low, a hair above 0.40%.

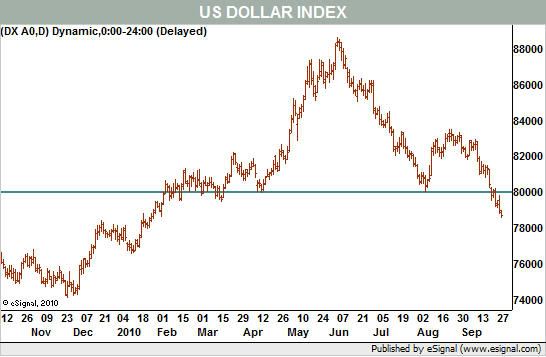

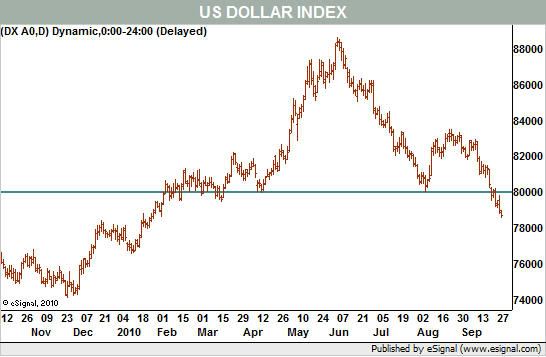

The U.S. dollar also expressed its concern. One week ago, the U.S. Dollar Index (DXY), a measure of the dollar against a trade-weighted basket of other currencies, broke down below a very important support level at 80 (see Chart 1). In fact, the dollar has been in a declining trend since June.

Chart 1

Given the very heavy representation of the euro in the dollar index, we might conclude that it is European strength that is driving the greenback down. But the euro is only part of the story as both the Australian dollar and Japanese yen have been strong. The former is seen as a beneficiary of the current commodities rally (see Getting Technical, Signs of a Recovery May Be Hidden in Charts, Sept. 20, 2010). The latter is seen as another safe haven where money moves in times of economic uncertainty with even the Bank of Japan\'s massive intervention having little lasting impact.

Granted, a weak dollar helps U.S.-based exporting companies, and indeed big, multinational stocks on the U.S. exchanges are beating smaller, domestically oriented stocks. But a falling currency only helps until it hurts.

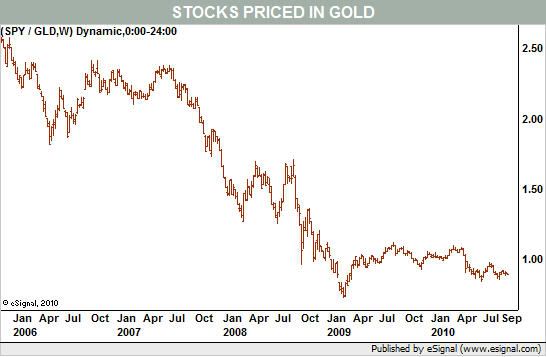

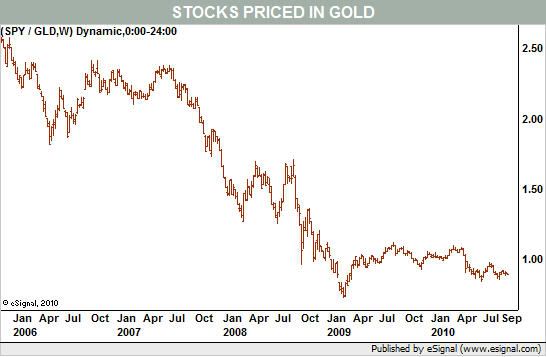

So is the weak dollar, and not a positive outlook for the economy, boosting stock prices? Chris Carolan, proprietor of the Carolan.org analysis firm thinks so. He points out that the stock market priced in gold has barely lifted off its March 2009 lows (see Chart 2).

Chart 2

This chart consists of the SPDR S&P 500 exchange-traded fund (SPY) divided by the SPDR Gold Trust ETF (GLD), which means it can be easily reconstructed using free online charting packages such as Stockcharts.com. By changing the pricing mechanism of the stock market from nominal dollars to the purchasing power of gold, we can see an undeniable multiyear bear market still in force.

To be sure, a falling dollar does boost the price of gold as well since it is priced in dollars. But gold has rallied for nearly a decade as the dollar gyrated wildly. Indeed, gold has made highs in terms of all major paper currencies. Gold is in a bull market no matter how we look at it.

For the near-term, stocks continue to show strength — but only in terms of depreciating dollars. In real terms of a golden constant, the stock market has barely maintained its value.

Strong Stocks or Debilitated Dollar?

By MICHAEL KAHN

Stocks are up only in terms of a declining dollar. In real terms, relative to gold, stocks have gone nowhere.

THE STOCK MARKET IS ON track to crush September\'s evil reputation as the worst month of the year. But at the same time, gold is setting new record highs almost daily while the U.S. dollar sinks steadily.

Something is wrong with this picture, which means it\'s no time to stop paying attention.

Any chart watcher knows that arguing with price action as it unfolds results in frustration at best and losses at worst. Most of the time, we have to swallow bad news, such as falling consumer confidence, and follow the market higher.

Technically, equities indeed are resilient and seemingly every other day shake off morning weakness to rebound by the close. Stocks reaching new 52-week highs are plentiful while stocks at the other end are scarce. And for all the fuss that many (including me) made of moving average death crosses in July, the major indexes are on track for the opposite signal --golden crosses-- in which the 50-day moving average breaks above the 200-day moving average.

So what\'s the problem? Basically, negative factors don\'t matter until they do. Only retrospectively do their importance reveal themselves.

The bond market continues to voice its displeasure with the economy. When risk assets were in demand in July, the two-year Treasury note yield fell in protest. When risk assets fell in August, the two-year yield fell to record lows as money flowed to safety. And again this month, when investors flocked to stocks and commodities, the two-year yield dipped to yet another record low, a hair above 0.40%.

The U.S. dollar also expressed its concern. One week ago, the U.S. Dollar Index (DXY), a measure of the dollar against a trade-weighted basket of other currencies, broke down below a very important support level at 80 (see Chart 1). In fact, the dollar has been in a declining trend since June.

Chart 1

Given the very heavy representation of the euro in the dollar index, we might conclude that it is European strength that is driving the greenback down. But the euro is only part of the story as both the Australian dollar and Japanese yen have been strong. The former is seen as a beneficiary of the current commodities rally (see Getting Technical, Signs of a Recovery May Be Hidden in Charts, Sept. 20, 2010). The latter is seen as another safe haven where money moves in times of economic uncertainty with even the Bank of Japan\'s massive intervention having little lasting impact.

Granted, a weak dollar helps U.S.-based exporting companies, and indeed big, multinational stocks on the U.S. exchanges are beating smaller, domestically oriented stocks. But a falling currency only helps until it hurts.

So is the weak dollar, and not a positive outlook for the economy, boosting stock prices? Chris Carolan, proprietor of the Carolan.org analysis firm thinks so. He points out that the stock market priced in gold has barely lifted off its March 2009 lows (see Chart 2).

Chart 2

This chart consists of the SPDR S&P 500 exchange-traded fund (SPY) divided by the SPDR Gold Trust ETF (GLD), which means it can be easily reconstructed using free online charting packages such as Stockcharts.com. By changing the pricing mechanism of the stock market from nominal dollars to the purchasing power of gold, we can see an undeniable multiyear bear market still in force.

To be sure, a falling dollar does boost the price of gold as well since it is priced in dollars. But gold has rallied for nearly a decade as the dollar gyrated wildly. Indeed, gold has made highs in terms of all major paper currencies. Gold is in a bull market no matter how we look at it.

For the near-term, stocks continue to show strength — but only in terms of depreciating dollars. In real terms of a golden constant, the stock market has barely maintained its value.

评论

目前还没有任何评论

登录后才可评论.