How fast can demand for oil be reversed?

While CNBC is back to playing the China card, the Iran card and talking about a dwindling supply of oil or "Peak Oil" while ignoring the very obvious role of demand destruction, the EIA quietly releases tables that clearly indicate what a crock the whole thing is.

In 2004 Global oil consumption was 82.33 Million barrels a day, that is a FACT. Last year, global oil consumption was 85.40Mbd, another FACT. That’s an average increase in demand of just over 1 Million barrels a year yet the EIA projects demand to rise to 87.95Mbd in 2009, a jump of 1.275Mbd, 27% ahead of the historic run rate. Does this really seem logical with oil at $130 a barrel? What does seem logical is that production is actually expected to increase from 84.60Mbd to 88.07Mbd over the same period, that would be 920,000 barrels a day more than we need, even with these very bullish demand assumptions.

We were discussing over the weekend that simply following good vehicle maintenance procedures can improve fuel efficiency by 15% and driving over 65Mph knocks another 7% off the mileage of most vehicles for EACH 5 mph over. Keeping your care washed properly can knock another 7 percent off your fuel bill (aerodynamics) and, of course, people could simply not buy Hummers and double their mileage.

Governments that aren’t owned by oil companies, like Canada, support economizing and May had, in fact, "Be Tire Smart" week in Canada because Canada and the US could offset China’s TOTAL growth in fuel consumption the past 3 years (1.14Mbd) by simply inflating our tires properly.

So the supply side of oil is NOT a problem, as even with these very aggressive demand projections supply is projected to be more than adequate for the rest of this decade. But what if the demand projections, with oil selling for 150% more than it was in Q1 ‘07, are a little bit high? What if global demand drops 5% (4.2Mbd)? What if it drops 10% (8.5Mbd)? What if global consumption, rather than rising 5% as expected in the next 2 years, drops 15% (12.7Mbd)? That would create a gap between supply and demand of over 16 MILLION barrels PER DAY - more than twice China’s total daily consumption.

Which is the more likely scenario: That people will do something to cut down on their use of an item that jumped up 150% in price in 12 months, or that demand, as is currently projected, will increase faster than it has over the past 3 years? If you drill the tables down to the quarterly level, you can see the demand already falling off from last quarter while supply is growing at a very robust pace - the exact opposite of what they are telling you in the MSM!

In Q1 ‘04 the US had 919Mb in commercial inventory, in Q1 ‘05 it was 973, ‘06 had 1005, ‘07 had 988 and this year we had 958Mb in Q1. Global inventories are UP 83Mb since 2004 and, of course, our President has puchased 162 Million barrels for the SPR before an act of Congress forced him to stop. Still, that means that the US commercial + government inventory is up from 1.46Bn barrels in 2004 to 1.66Bn barrels, an increase of 13.6% or 20 days of imports more than we had in 2004.

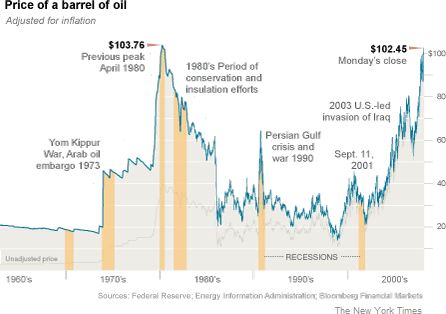

At the same time (2004-2008) the EIA estimate of "World Proved Crude Oil Reserve" rose from 1.265Tn barrels to 1.331Tn barrels, or a 2 year net increase in global supply over 4 years. The worst crisis ever to affect oil supply was the Iranian revolution, which took 5.6Mbd off the global market for 6 months in 1979, at a time when there was no SPR. The second worst supply disruption ever was Bush I’s Gulf war, wihich knocked 4.3Mb a day off the market in 1990 and the Arab-Israeli war, which took 4.3Mbd off the market for 6 months in 1973. Why it’s always 6 months, I don’t know… What I do know is that global supply and consumption back then was less than 50Mbd, so we’re talking 10% of the supply of oil in the world knocked out with no strategic petroleum reserves and NOT ONCE did oil come anywhere near the levels we’re at today (inflation adjusted). The price of oil has changed so much since this April chart that it’s already 30% behind on the current price!

At a meeting in Aomori, northern Japan, over the weekend, Group of Eight energy ministers plus officials from three Asian oil consumers put the spotlight on energy efficiency as the most immediate solution to record oil prices. The G-8 representatives and their counterparts from China, India and South Korea voiced their "serious concerns" at the sharp run-up in crude to a record settlement Friday of $138.54 a barrel and agreed to set up an umbrella body to promote more widespread energy-saving initiatives and to share experience.

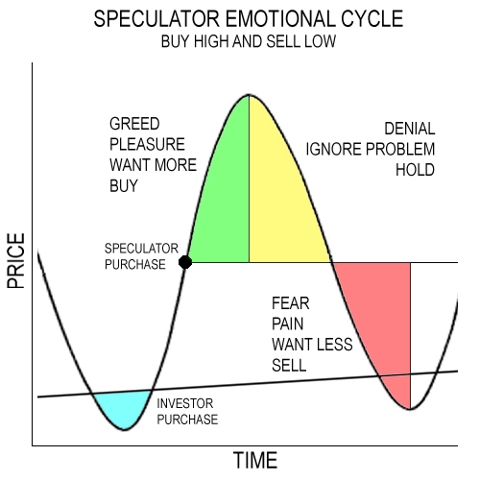

With global government reserves over 1.4Bn barrels and commercial inventory accounting for another 2.5Bn barrels, the World is prepared to weather a supply disruption of 10Mbd for over a year. So let’s stop calling the people running up the price of oil "speculators" and start calling them what they really are - IDIOT SPECULATORS!

We picked up USO puts on Friday as on thing we feel is certain is that we WILL run out of idiots before oil can hit $150 a barrel. In order to get oil to $150 a barrel, global consumers must kick in an extra $1.7Bn a day or $620Bn a year ABOVE what they are paying now for crude - and that’s not including refining mark-up or additional inflationary effects that trickle through the market. You will hear "analysts" in the MSM telling you people will pay $200 a barrel for oil or $2.2Tn more than we are paying now and that is just absurd! Even if that "only" translated to $7 per gallon gas, that translates into a $140 fill-up on a 20-gallon tank. The bull premise is we will pay this price without changing our driving habits - Like I said, idiots!

We picked up USO puts on Friday as on thing we feel is certain is that we WILL run out of idiots before oil can hit $150 a barrel. In order to get oil to $150 a barrel, global consumers must kick in an extra $1.7Bn a day or $620Bn a year ABOVE what they are paying now for crude - and that’s not including refining mark-up or additional inflationary effects that trickle through the market. You will hear "analysts" in the MSM telling you people will pay $200 a barrel for oil or $2.2Tn more than we are paying now and that is just absurd! Even if that "only" translated to $7 per gallon gas, that translates into a $140 fill-up on a 20-gallon tank. The bull premise is we will pay this price without changing our driving habits - Like I said, idiots!

Will a person making $8 an hour (minimum wage is $5.85) drive 25 miles to work, using 2 hours’ pre-tax pay just to get to work? Will we have massive wage inflation or will the entire economy collapse? Those are our two choices as we’re not going to "grow our way out of" this one.

As I’ve been saying, this is nothing more than Housing Bubble II and clearly we’ve seen housing speculation (as well as speculation in asset-backed securities) go through this cycle. We are looking for that elusive bottom as we investors begin to bottom-fish the banks (we still won’t touch most builders) but we probably have plenty of time to get in on the great oil collapse when it hits because the denial is going to be extreme on the way down. Perhaps we’re seeing it now, very possibly all of Thursday and Friday’s action was simply a temper tantrum kicked up on the NYMEX by manipulators who were given a green light by Congress to fiddle with markets with impunity (for now). We should have a clearer picture by Wednesday, and next Wednesday is the last inventory report before July oil contracts close (now at 324,029 open contracts with 143,402 in Aug, 123,722 in September and 53,916 in Sept). Notice on the NYMEX chart that the last time someone ordered a barrel in 2012, oil was at $70.85 - does that seem just a bit funny to anyone else?

Asia avoided a huge drop this morning because Hong Kong and China were closed for a holiday (very lucky break for them) but the Nikkei dropped 308 points (2%). "We’re swinging from optimism to pessimism. Everybody was focused on the credit crunch being over and ignored inflation risks — now it’s coming home to roost," said UOB Kay Hian analyst K. Ajith. India was open but sorry about it and gave up 506 points (3%) touching the 15,000 mark, which is a very dangerous support level to break.

Asia avoided a huge drop this morning because Hong Kong and China were closed for a holiday (very lucky break for them) but the Nikkei dropped 308 points (2%). "We’re swinging from optimism to pessimism. Everybody was focused on the credit crunch being over and ignored inflation risks — now it’s coming home to roost," said UOB Kay Hian analyst K. Ajith. India was open but sorry about it and gave up 506 points (3%) touching the 15,000 mark, which is a very dangerous support level to break.

The Saudis are attempting to forestall demand destruction in Pakistan by "deferring Pakistani oil payments as the South Asian nation’s economy struggles." Hey guys - how about a little deferment for your great buddy Bush? Pakistan imports about 250,000 barrels a day from Saudi Arabia, the news service said. Rising oil prices have increased Pakistan’s oil bill by more than 40% in some 10 months. Our Republican friends in the Senate did their part to support coal prices by filibustering the climate bill, which was aimed at promoting clean energy through cap and trade agreements that are supported by all 3 current Presidential candidates.

Europe showed up for work today and and shook off a negative close to get slightly positive as oil dropped $2 ahead of the NYMEX open. Once those crooks get their hands on things, there’s no telling where the POO will fly but, for now (8 am) things don’t look too terrible this morning. Banks and airlines continued their downtrend and both BCS and LEH are rumored to be looking for more capital.

UK PPI rose 1.3% in one month, now up 8.9% for the year and economists said the output price data highlighted the risk that consumer price inflation, due to be released next week, will jump to more than one percentage point above the central bank’s 2% target, after it climbed to 3% in April. That would force Bank of England governor Mervyn King to write an explanatory letter to the government. "Overall, there seems no end in sight for the horror story on the U.K. economy, [with] surging price pressures and disappearing growth prospects," said Alan Clarke, U.K. economist at BNP Paribas. "In fact, things could get even worse, with the threat of an interest rate hike becoming a distinct possibility."

So our long-term bullish premise remains intact - No matter how awful things get over here, we still look better than the rest of the planet! In Spain, "tens of thousands of Spanish truckers began an indefinite strike Monday over soaring fuel costs that could bring the country to a standstill." The strike comes as a strike by Spanish fishermen over fuel prices entered a second week. News reports said smaller boats that fish closer to the coast had now joined the protest which began May 30. The stoppages are part of Europe-wide protests against rising prices.

This is what the oil bulls just don’t get, WE ARE PAST THE BREAKING POINT ALREADY!

Lehman (LEH) is at the breaking point, booking a $2.8Bn loss and looking to raise $6Bn in fresh capital so we’re really glad we stayed away from that "bargain" last week! AIG (AIG), which is down 41% for the year is having a shareholder revolt as three major shareholders have asked the board for a meeting to discuss "steps that can be taken to improve senior management and restore credibility."

We’ll be looking for our own market to show us some credibility above the 12,300 mark, anything less than that is a failure without a doubt. The Nasdaq has been zoning between 2,475 and 2,525 and I don’t feel bad grabbing ProShares UltraShort QQQ (QID) $38 puts at the open for $1 with the intent to roll up to the $39 puts for .40 if it goes the wrong way, but I very much doubt we’re going much lower without a retest of 12,400 UNLESS oil goes back above $137.50, which I also doubt.

What we’d like to see today is some good old-fashioned consolidation with at least a 1/3 retrace of Friday’s losses. We have the Apple (AAPL) developer’s conference coming up at 1pm that can boost the Nasdaq right back over 2,500 and we also have Pending Home Sales at 10am, which will be hard to see as disappointing as we have such low expectations (down 1%). Tomorrow we get good Trade (im)Balance data pre-market and Wednesday, in addition to Crude Inventories, we get the Beige Book, which will give us a good view on the Fed’s view of the economy.

What we’d like to see today is some good old-fashioned consolidation with at least a 1/3 retrace of Friday’s losses. We have the Apple (AAPL) developer’s conference coming up at 1pm that can boost the Nasdaq right back over 2,500 and we also have Pending Home Sales at 10am, which will be hard to see as disappointing as we have such low expectations (down 1%). Tomorrow we get good Trade (im)Balance data pre-market and Wednesday, in addition to Crude Inventories, we get the Beige Book, which will give us a good view on the Fed’s view of the economy.

The week ends with Import Prices and Retail Sales on Thursday and the Big Kahuna is CPI on Friday so it’s going to be a wild one. We’ll see if last week was nothing more than a short squeeze on the oil bears and a flush of the retail stock bulls ahead of the exact opposite thing happening in both of those markets. We’re not going to get ahead of ourselves, we need a real pullback in oil to sustain a real rally in the markets but, funamentally - there’s no reason we can’t have both…