子夜读书心筆

写日记的另一层妙用,就是一天辛苦下来,夜深人静,借境调心,景与心会。有了这种时时静悟的简静心态, 才有了对生活的敬重。Each month, the US Treasury publishes its International Capital account (TIC) which foreign currency traders and bond dealers use to gauge the flows of money from around the world, into and out of the US capital markets. The demand for a nation’s bonds and stocks, combined with international trade flows for goods and services, plus behind the scenes intervention by central banks, all act in concert to influence the foreign exchange market which handles $4 trillion per day.

The release of the TIC report often sparks a flurry of trading activity in the foreign exchange market, due to speculators seeking to earn a fast profit. However, the initial knee-jerk reaction to the news headlines, can be very misleading, and often isn’t long-lasting. For instance, the US Dollar Index, measured against a basket of six currencies, defied conventional logic in February, by climbing +2.7% higher, even in the face of a net outflow of $91 billion in the TIC account.

Instead, large off shore traders are influencing exchange rates, and their betting patterns are difficult to discern on the G-20’s radar screens. The finance ministers of the "Group-of-20" (G-20) recognize the growing threat to their control over the currency markets, and are calling for increased regulation of hedge funds and shadow bankers, insisting on full disclosure of their locations and other information to assess the risks they pose to the manipulations of the major central banks.

click to enlarge

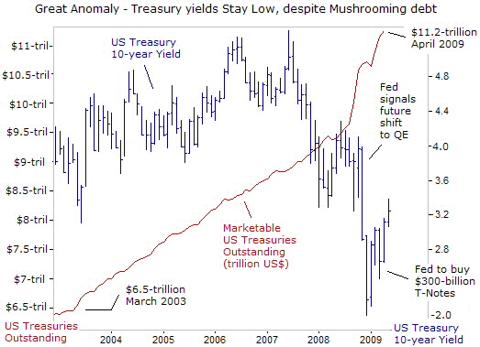

The United States has become dangerously dependent upon the whims of foreign investors, to help finance its massive budget deficits, and prevent a surge in long-term interest rates, which would have a devastating impact on the US economy. If bond or currency traders detect that big investors in US government bonds, such as China, Japan, OPEC, Russia, and Brazil, have ceased to buy US Treasury debt, or worse yet, are becoming net sellers, it could spark a sharp slide in US Treasury notes, sending yields sharply higher, and ignite a free-fall in the US dollar.

Last week, the US Treasury tried to reassure bond and currency traders, that foreign investors haven’t abandoned the American debt markets, despite the avalanche of new debt that is swamping the market. The US Treasury claims that China and Japan were net buyers of a combined $48.5-billion of Treasuries in March, and that Moscow was a net buyer of $8.3-billion. Yet the reliability and accuracy of the TIC report should be viewed with a grain of salt, and a healthy dose of suspicion - perhaps the figures were conjured-up under the guise of "mark-to-make-believe" accounting.

President Barack Obama’s stimulus program could boomerang and destabilize on US-economy. No one is asking who will purchase the remaining $1 trillion of US Treasuries to be auctioned by September. Once that colossal amount of paper is bought, who will purchase another $5-trillion of Treasury paper over the next four years, as the US-government plunges deeper into insolvency? The Federal Reserve would be forced to print (monetize) vast quantities of US dollars to pay the principal and interest on the national debt that is not covered by tax revenue.

The US dollar’s surprising strength since last July was largely attributed to "de-leveraging" and "risk-aversion," which are references to the unwinding of "carry trades," in the foreign exchange market. On April 6th, famed hedge-fund trader George Soros remarked, "The US-dollar is not strong because people want to hold the dollar, but it’s strong because people have debt in dollars."

The enormous fortunes of Wall Street’s aristocracy were built-up on the leveraging of debt, including "carry-trades," in order to buy exotic securities built around sub-prime mortgages, and other instruments of financial speculation. But when the global commodity and stock markets began to meltdown following the collapse of Lehman Brothers, carry-traders began massive de-leveraging - the selling risky assets and buying US dollars and Japanese yen, to pay down margin loans.

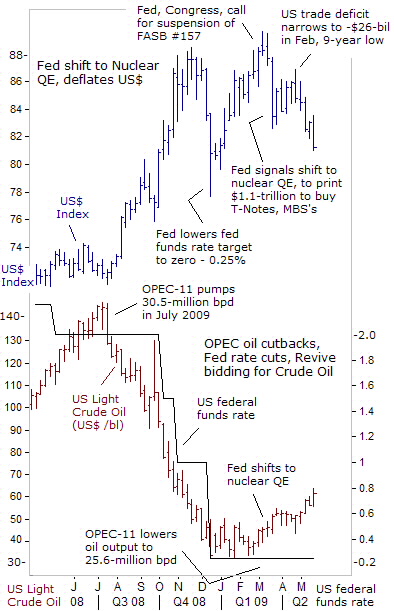

There was also a stunning contraction in the US trade deficit, narrowing from $62.5-billion in August to $26-billion in February, its lowest level in nine-years, bolstering the greenback. The US current account deficit, which had increased for five straight years, fell to $673 billion in 2008 from $731 billion in 2007. The deficit equaled 4.7% of the overall US economy last year, down from 5.3% in 2007.

But the US dollar’s "risk-aversion" rally came to an abrupt end on March 18th, when the Federal Reserve shocked the markets by announcing that it would unleash its nuclear weapon, "Quantitative Easing" (QE), by printing $1.1-trillion US dollars off its electronic printing press, to monetize US T-Notes and mortgage backed securities, in an all-out effort to prevent a deflationary spiral in the US economy, which in turn, could lead to widespread defaults on debt and bankruptcies.

By pumping vast quantities of US dollars into the global money markets, easily outstripping the money printing operations in England, the Euro-zone, Japan, and Switzerland, the Fed has headed off the prospect of deflation. Instead, the Fed has reawakened the "Commodity Super Cycle," led by the kingpin crude-oil market, which is feeding off a weaker dollar and ultra-low interest rates worldwide. Crude oil rose above $62 per barrel today, from as low as $35 in January.

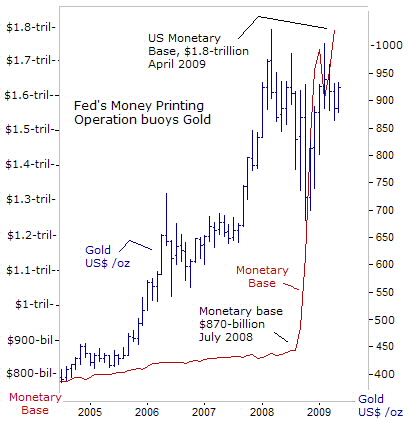

The Fed has pumped $1-trillion into the banking system since July, increasing the monetary base to a record $1.87 trillion, while pegging the fed funds rate near zero-percent. Super-easy money, beloved by Fed chief Ben "Bubbles" Bernanke, US Treasury chief Tim "Turbo-tax" Geithner, corrupt Washington politicians and Wall Street Oligarchs, is a traditional recipe for an asset bubble. While the rapid expansion of the US-monetary base is buoying the gold market above $900 /oz, other G-20 central banks are also letting the inflation-genie out of its bottle, providing the yellow metal with a huge advantage over government toilet paper.

"Our actions have succeeded in pulling the financial markets and the economy from the edge of the abyss, beating back deflationary pressures, and set the stage for a recovery," declared Dallas Fed chief Richard Fisher on April 15th. Fisher argues the US economy’s low capacity utilization rate, near 69%, would keep inflationary pressures under wraps. "It is doubtful that inflation will raise its ugly head until employment picks-up and capacity utilization tightens," he said.

Higher inflation down the road means the Fed must at some point, break its addiction to easy money, and dismantle the QE framework, which has flooded the money markets with hundreds of billions of dollars. "Nobody I know on the FOMC wants to maintain our current posture for any longer and to any greater degree than is minimally necessary to restore the efficacy of the credit markets and buttress economic recovery without inflationary consequences," Fisher said.

The FOMC "can ill afford to be perceived as monetizing that debt, lest we come to be viewed as an agent of inflation, rather than an independent guardian against future inflation," the Fed’s propaganda artist said. Typically however, Fed officials continue to keep the printing presses rolling at full-speed, long after inflation has already reared its ugly head, and hyper-inflationary psychology becomes deeply embedded within the minds of commodity traders and the public at large.