股市小书生

价值投资2017-01-02 17:39:54

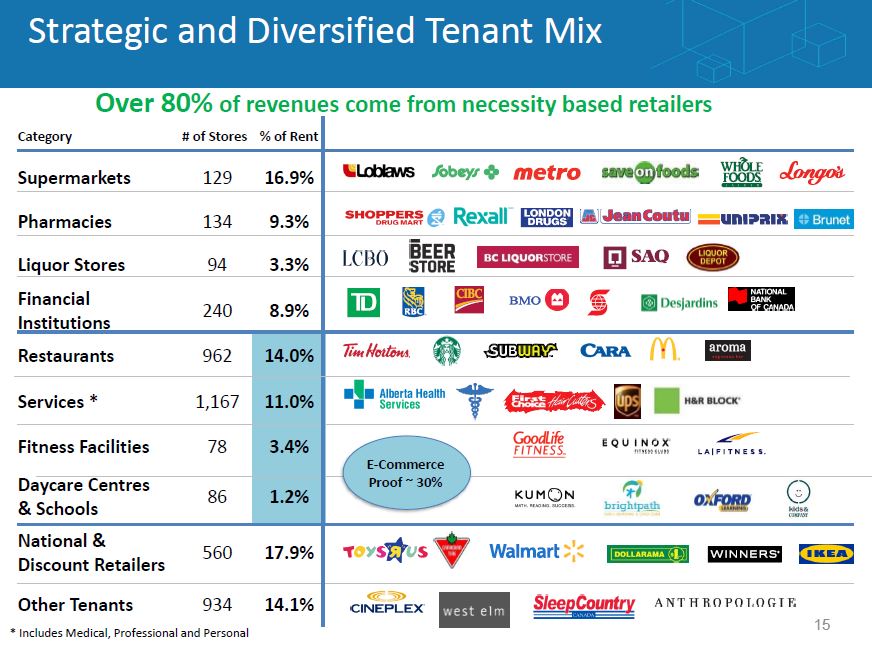

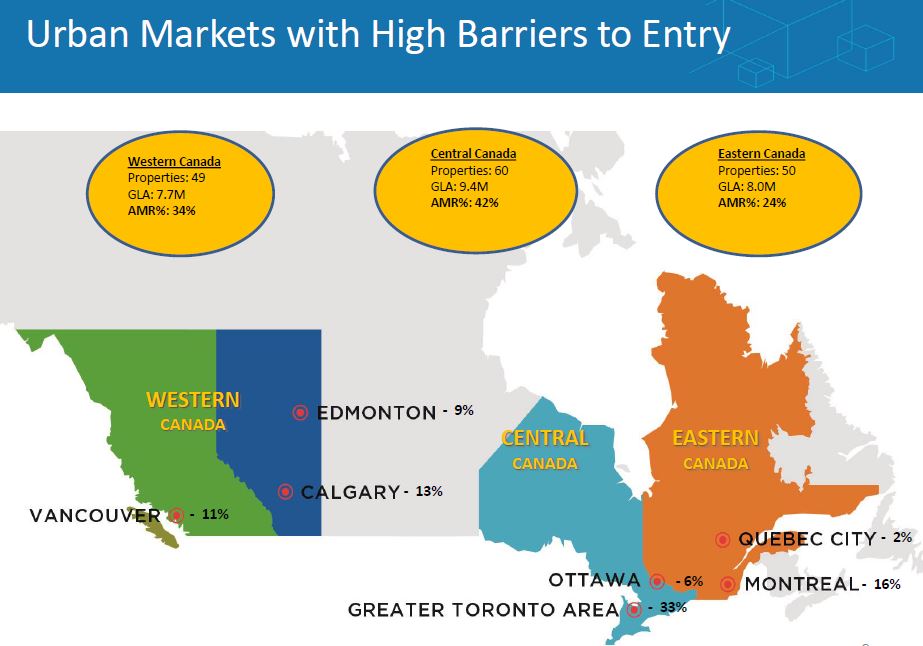

First Capital Realty (TSX:FCR)是加国市场上的一家地产公司,目前属于同行业中的第一梯队。我从一开始了解FCR,就比较喜欢这家公司,因为它的发展线路十分的明确,容易理解。

FCR在现在的管理层接手之前,主要合作对象是一家大连锁商家,记不得是Sears还是Zellers,反正是不行了,所以当时经营不佳,债台高筑,在被现管理层接手后,调整了发展方向,不但是走出了困境,而且成为了同行中的姣姣者。同样的生意, 不同的人,可以有不同的结果。FCR的前管理层离开以后,又重新参与了新的公司 First Service Corp, 干得相当的成功,同样的人,不同的生意,也可以有不同的结果。

其实,我蛮羡慕像梁山,如山等能自己动手干地产项目的人,因为在经济利益之后,还能有很大的成就感。但是我知道我干不了这样的事。

这是多市东部地区的Chartwell Shopping Centre,以前有网友在投坦提到过,这原本是个老旧的小商场,FCR通过改造,将其更新为一个现代式样的商场,这里的一个重点是,照片上方的那一排店面原先是一个工业建筑,FCR通过购买改建,合并到原有的小商场,因为有大型华人超市入住,这彻底改变了原先的格局。我记得网友提到过,通过改变房产用途,可以使原有房产增值1500 万。FCR有很大部分的业务是改造这样的旧商场,因为城市的发展,人口的增加,这是个可以长期持续发展的业务,而FCR很擅长这项业务。

虽然,我自己动不了手直接参与城市的改建发展,但是通过股市,我也有机会可以间接的参与其中。

我不懂地产项目的实际投资,经营和管理,但是我懂一些股市投资,这是我自己所擅长的。

我用学习的投资常识来思考FCR的投资机会。

"Shares are not mere pieces of paper. They represent part-ownership of a business. So, when contemplating an investment, think like a prospective owner." - Warren Buffett

"Investment is most intelligent when it is most businesslike. “ - From Chapter 20 of Benjamin Graham's book The Intelligent Investor:

不需要花太大的精力,就可以理解, FCR是个蛮不错的生意,有长期的盈利能力和发展机会。加国的长期城市发展和移民人口的增长,是确定无疑的。FCR的管理层的长期表现也是合格的,控股股东的利益也是完全与企业的未来经营发展融合的。

做为一门生意,FCR是值得投资的,而且是可以长期的。

Warren Buffett: “Price Is What You Pay, Value Is What You Get.”

FCR的股票价格长期以来,一直是不太便宜的,所以如果以市场均价买入,长期的投资回报也只能是一般,而且在未来的市场波动中,长期持股会有难度。

如果,我可以用市场均价的一半建立FCR的长期持股仓位,是我比较理想的方式。在实际投资操作中,有可能实现这样的长期投资目标吗?我该怎么做?

2011年,老巴印度之行的谈话

“If you look at the typical stock on the New York Stock Exchange, its high will be, perhaps, for the last 12 months will be 150 percent of its low so they’re bobbing all over the place. All you have to do is sit there and wait until something is really attractive that you understand.”

“There’s almost nothing where the game is stacked more in your favor like the stock market”

“What happens is people start listening to everybody talk on television or whatever it may be or read the paper, and they take what is a fundamental advantage and turn it into a disadvantage. There’s no easier game than stocks. You have to be sure you don’t play it too often”

简单而言,在FCR一年低价区域买入股票,在一年高价区域卖出一半,可以接近我的长期持股的理想模式,所以机会是存在的,机会不多也不少,平均一年一次。

如果,在低价位大量买进以后,股票价格又跌了怎么办?

在思考FCR的投资可能性时,我考虑的第一件事是FCR商业模式的长期盈利能力,在这个前提下,当股票价格出现极度超跌时,

Buy as much as you can!

it's not risky to buy securities at a fraction of what they're worth. – Warren Buffett

2010年,芒格的演讲 ART OF STOCK PICKING

It's not given to human beings to have such talent that they can just know everything about everything all the time. But it is given to human beings who work hard at it who look and sift the world for a mispriced be that they can occasionally find one. And the wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don't. It's just that simple.

I've learned many things from him (George Soros), but perhaps the most significant is that it's not whether you're right or wrong, but how much money you make when you're right and how much you lose when you're wrong. - Stanley Druckenmiller as quoted in The New Market Wizards

The trouble with you, Byron [Byron Wein – Morgan Stanley], is that you go to work every day [and think] you should do something. I don’t, I only go to work on the days that make sense to go to work. And I really do something on that day. But you go to work and you do something every day and you don’t realise when it’s a special day. - George Soros

巴菲特:“當天上掉金子的時候,應該用大桶去接,而不是杯子。 ”

这里只是用最简单的投资常识,来思考FCR的投资可能性。