Whatever Happened To “The Magic Of The Marketplace” And "the Invisible Hand?" By Sandy Goodman a retired producer for NBC Nightly News

Who Gives Invisible Hand of Adam Smith a Super Power?

Frank May 12, 2014 in Waterloo, Ontario, Canada

Revised in Jan. 29, 2018

http://frank-waterloo.blog.163.com/blog/static/205239029201441261651348/

This is an excerpt from my July 29 2012 article To Make Possible from Impossible by Breaking the Shackles of Dogmatic.

Adam Smith. a British economist who wrote The Wealth of Nations in 1776 to have coined the Invisible Hand - the free market managing the economy, and giving up the visible hand of government intervention.

This doctrine has been touted as the economic Bible since it was born. Although it has caused many insurmountable economic problems, especially cyclical economic crisis, the interest groups still advocated that market should be more aissez-faire.

For a long time, there was no one doubted Invisible Hand's correctness and dared break the dogma.

It was John Maynard Keynes, a British economist, who not only appealed that laissez-faire should be ended, but also provided useful financial instruments to have saved economy.

Here, I think that there are necessary to talk a little more about Invisible Hand.

It said that was Rothschild banking family of England to have persuaded and funded Adam Smith to write The Wealth of Nations with the purpose to pave a Boulevard for their controlling the national economy especially the monetary system by disabling the function of supervision of the Government.

Some scholars have questioned the understanding for Invisible Hand. Among them, there is a most powerful questioner, Emma Georgina Rothschild who is a descendant of the Rothschild banking family, a British economic historian and a professor of Harvard University. In 2001, She published Economic sentiments: Adam Smith, Condorcet and the Enlightenment to question the understanding for Invisible Hand. In the paragraph of The Bloody and Invisible Hand she said that:

“The Invisible Hand of Jupiter"

"Adam Smith's ideas have had odd secular destinies, and the twentieth century was the epoch of the invisible hand." the profoundest observation of smith," for Kenneth Arrow, is "that the system works behind the backs of the participants; the directing 'hand' is 'invisible' "For Arrow and Frank Hahn, the invisible hand is "surely the most important contribution [of] economic thought" to the understanding of social process; for James Tobin, it is "one of the great ideas of history and one of the most influential." 'The object of this chapter is to look at the intellectual history of the invisible hand, and to put forward a view of what Adam Smith himself understood by it. What I suggest is that Smith did not especially esteem the invisible hand. The image of the invisible hand is best interpreted as a mildly ironic joke. The evidence for this interpretation, as well be seen, raises interesting questions both about Smith and about the invisible hands of the twentieth century.””

Another questioner is Gavin Kennedy who is a retired professor of business historyand the history of economics, now is a prolific blogger. His central topic is Adam Smith’s “lost legacy”, on which he has written two books. His Blog has focused on the misuses of the metaphor of “the invisible hand”. He has questioned that Smith used the metaphor 3 times, but only once was in , and never expressed anything like a “theory” of the invisible hand. In paper <Adam Smith and the Invisible Hand: From Metaphor to Myth>” he said that “A far cry from the almost mystical force it later acquired.”

June 21, 2010, on the Website of Adask's law, there is a post <The Real Father of Modern Economics> said that, “Where Smith advocated a “free market” wherein each individual’s “self-interest” would result in “benefit” to all, our current markets are manipulated and their “benefits” are primarily reserved for a few “insiders” rather than the nation at large. Smith advocated “natural liberty”; today’s economics push for debtor bondage. Smith’s classical (moral) economics promoted The Wealth of Nations; today’s monetary economics promotes The Wealth of Special Interests (or perhaps, The Wealth of Bankers).” The writer indicated that “the “father” of today’s monetaryeconomics” is “Mayer Amschel Rothschild (A.D. 1743-1812), the founder of the Rothschild fortune and dynasty that controls much of the world’s economy to this day.”

From above comments, we may understand that appealed to control the economy by the Invisible Hand instead of regulation of Government was not the original intention of Adam Smith but intended advocated by interest individual or group for removing the barrier of their looting social wealth. Although, the thought of Keynes that Government intervenes in the economy has applied widely, however, the Invisible Hand is still misused widely, too. Because there are no enough regulations to restricting to those greedy people who are protected by the umbrella of Invisible Hand, so that caused the disaster of Financial Crisis of 2007–2010, and will be to gestate more disasters inevitably.

Since the occurrence of Financial Crisis of 2007–2010, people began to doubt the free market. April 6, 2011, a report that Sharp Drop in American Enthusiasm for Free Market, Poll Shows said that “The findings, drawn from 12,884 interviews across 25 countries, show that there has been a sharp fall in the number of Americans who think that the free market economy is the best economic system for the future.” “Americans with incomes below $20,000 were particularly likely to have lost faith in the free market over the past year, with their support dropping from 76 per cent to 44 per cent between 2009 and 2010. American women have also become much less positive, with 52 per cent backing the free market in 2010, down from 73 per cent in 2009.”

Contrasted sharply, people around the world renewed emphasis on Marx's thought, especially in Marx's home country Germany. In 20 October 2008, a paper Marx popular amid credit crunch reported that Karl Marx's Das Kapital that published in 1867 now is back in fashion. Says one German publisher, who attributes his new popularity to the economic crisis. “German media have reported that bookstores nationwide have seen a 300% increase in sales of the book in recent months.”

The results on the view of free market are a new proof of some people seems accustomed to fall into the trap of dogmatism without the dialectical sense in the observation of things – that is that there are two sides to everything; the Invisible Hand certainly has its rational part and irrational part. We must be good use of its rational part and avoiding the harm of its irrational part. In the practice of intervening in the economy, the different components of the market should be treated differently. For the traditional manufacturing sector, we should implement fully liberalized market to be controlled by Invisible Hand, through the price to regulate the production automatically. For the financial sector, it can not be taken as complete free market. Especially, the international hot money should be identified and banned because it is playing a role of advanced bandits in modern society and the financial derivatives should be strictly controlled by the Visible Hand. The occurrence of the Financial Crisis of 2007–2010 was certainly not the guilty of the Invisible Hand, it was the guilty of governors because of they did not well regulate the part of the market that must be regulated.

There is a question worth pondering, which is that Adam Smith requested to burn his manuscripts when his life went into critical state. Some people have guessed that, may be it was that Adam Smith thought his writings were too mean to consistent with his personal morality, even a proof of <The Wealth of Nations> were written under the force of others.

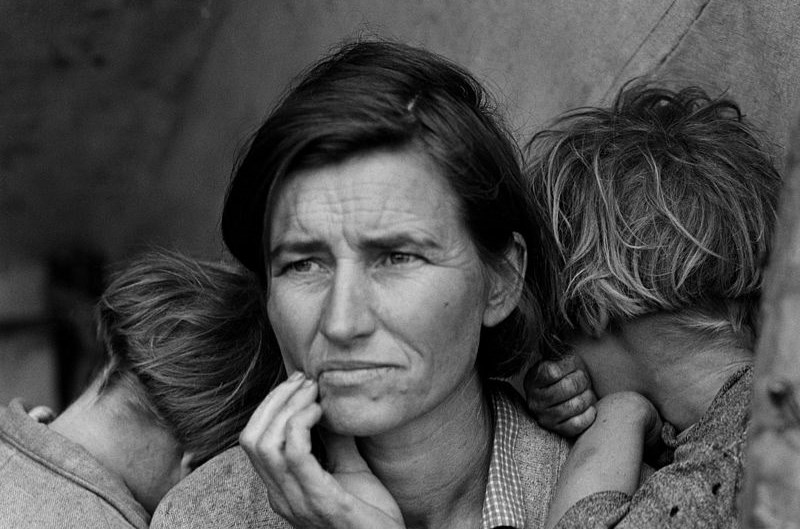

Above photo appeared in most of articles that introduce the Great Depression. Anxious mother and her hunger children have been demonstrating the tragic reality of the man-made disaster. Every time I saw it, I could not help but was full of tears in my eyes with wondering that whether the mother and her children survived through the difficult years. I think that it is a powerful proof of the sin caused by the irrational part of Invisible Hand. The tragedy showed in the photo might have been foreseen by Keynes and encouraged him to write The End. Also it might had been foreseen by Adam Smith, thereby induced him to have requested to burn his manuscripts when he was ready to return to the eternal.

The topic about Adam Smith will stop here. You may think that many ofthe comments seem to have deviated from the main topic; however, I think thatis necessary. A successful conduct of individuals or enterprises must meet the moral standards of public consensus. Otherwise, even if they could make possible from impossible, the results may not be acceptable socially.

Whatever Happened To "The Magic Of The Marketplace"And "The Invisible Hand?"

By Sandy Goodman a retired producer for NBC Nightly News By Sandy Goodman a retired producer for NBC Nightly News

THE BLOG 11/16/2008 05:12 am ET Updated May 25, 2011

Hundreds of people rallied at the Capitol earlier this month, extolling the glories of the free market. “Free markets work all the time and every time,” one demonstrator shouted. “If people wanted to live in a socialist country, they’d move to Europe,” another cried.

It was one more piece of evidence showing how many Americans still believe in the myth of the always perfect free market, in the face of irrefutable, worldwide evidence that there are times when it completely fails. The protesters were also a dramatic reminder of the public’s distrust of government: this time, of the federal government’s efforts to begin to pull the country out of the greatest economic crisis since the Depression.

It took two weeks for Congress to pass the administration’s $700 billion bailout package. And both times the House voted on it, a majority of Republicans voted against their own president’s program. This, despite repeated, desperate pleas from Bush, GOP congressional leaders and powerful, reliably Republican lobbies like the U.S. Chamber of Commerce and the National Association of Home Builders that the nation faced “financial collapse” without government action.

There are, of course, some genuinely good reasons for such distrust.

The administration’s new bailout plan, as implemented by Treasury Secretary Paulson, leans heavily on partial nationalization of the nation’s banks, a very different program from the one he and President Bush envisioned only a few weeks ago, when they presented Congress with a policy aimed at buying toxic assets. At that time buying into banks was something the Administration wouldn’t even consider — the notion of some Democrats, radicals and other such kooks. It was not until the stock market solidly rejected their original plan, and the British and other European governments began buying bank shares, that President Bush, Paulson and their free market followers finally gave in.

Not without the obligatory reassurances, of course. Bush contended that the kind of Federal intervention not seen since the 1930s Depression “was not intended to take over the free market but to preserve it.” And Paulson chimed in that “We regret having to take these actions — but [they] are what we must do to restore confidence to our financial system.” In other words, the wonderful free market doesn’t always work. And when it doesn’t, the government has to come in and bail it out.

If the right-wing radicals and other undesirables who comprise the current Republican party would simply admit that and get on with it, that would settle matters. But they won’t. They blame the government, minorities, Fannie Mae, the Community Reinvestment Act, and anything else they can think of except good old underregulated Capitalism, American-style, for its horrific failure. They seem surprised that a game whose fans’ favorite cheer is “Hooray For Me and F**k You” has turned into a bloodbath because there aren’t enough referees and the few on the field look the other way.

Moreover, almost thirty years after President Ronald Reagan announced in his first inaugural address that “Government is not the solution to our problem; government is the problem,” and after his repeated invocations of “the magic of the marketplace,” the overwhelming majority of Americans still believe him, in the face of years of growing income inequality, corporate criminality and exploded stock market and housing bubbles that have brought us — and the rest of the world — to the brink of economic catastrophe.

A Rasmussen poll of 1,000 likely voters taken earlier this month showed that 59 percent of Americans still believe Reagan’s nonsense that government is the problem, with only 28 percent dissenting. It is a belief held by all demographic groups, with liberals the only political group dissenting. And even 35 percent of liberals believe it.

The overwhelming majority had better be wrong. Because right now, government is the only thing that stands between the American public and economic calamity.

On a more fundamental level, the next administration and Congress, both of which now appear likely to be Democratic, must reverse the public’s belief, successfully drummed into people by decades of right-wing think tank propaganda and talk radio hosts, that apart from national security, government serves no legitimate purpose. That silliness gives way to common sense — and is too soon forgotten — only when disasters like the Depression, the savings and loan, peso and hedge fund debacles and epidemics of corporate criminality remind us that government is necessary. The conservative commentator George Will was correct in January 2002, during the Enron-led corporate crime pandemic, when he wrote:

Enron’s collapse...will remind everyone - some conservatives painfully - that a mature capitalist economy is a government project. A properly functioning free market system does not spring spontaneously from society’s soil as dandelions spring from suburban lawns. Rather it is a complex creation of laws and mores...

Following the lead of Enron’s management, executives of more than a dozen other corporations went to jail, including those of Adelphia, Arthur Anderson, Charter Communications, Credit Suisse First Boston, Dynegy, HealthSouth, ImClone Systems, Merrill Lynch, Rite Aid, Tyco, Westar Energy and WorldCom. And dozens of leading companies, including Citigroup and J.P. Morgan Chase, two of the nation’s biggest banks, and Merrill Lynch, the biggest brokerage house, paid hundreds of millions of dollars in fines and penalties.

Those scandals barely lessened the worship of the free market that’s been economic orthodoxy in this country since the Reagan years. The high priest of this secular religion was the late economist Milton Friedman. In his 1962 book, Capitalism And Freedom, Friedman expressed the view that in a free market economy, corporations are responsible only to their stockholders, and have no responsibility to society in general:

Few trends could so thoroughly undermine the very foundations of our free society as the acceptance by corporate officials of a social responsibility other than to make as much money for their stockholders as possible.

... there is one and only one social responsibility of business -to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, which is to say, engages in open and free competition, without deception, or fraud... It is the responsibility of the rest of us to establish a framework of law such that an individual in pursuing his own interest is, to quote Adam Smith...”led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for the society that it was no part of it. By pursuing his own interest, he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good.”

One of the many problems with Friedman’s formulation is that powerful corporations can, through millions of dollars in campaign contributions and dozens of lobbyists, establish Friedman’s very “rules of the game” with which they can then happily comply. Too often, those rules discourage “open and free competition,” while in the case of too many corporations the rules encourage, rather than discouraging, deception and fraud. Not having the resources of big corporations or trade associations “the rest of us” are at a disadvantage to “establish a framework of law,” that can successfully constrain corporate greed.

Another big problem is the almost blind faith that Friedman’s followers and most other present-day economists have in Adam Smith’s “invisible hand.” They believe that the free market, unimpeded by government, will almost inevitably produce good outcomes. This kind of thinking substitutes theology for economics. And many times, it just isn’t true.

Smith, a Scottish philosopher and college professor, was, of course, the founder of modern capitalist economic theory. In context, it is clear that when he writes about “the invisible hand” in his first great work, The Theory of Moral Sentiments, and again in his more famous book, The Wealth of Nations, he is referring to the hand of God or some equally inexorable force of Nature. In “Moral Sentiments,” published in 1759, he ties the invisible hand directly to God. In “Wealth,” 17 years later, he is less specific. But here too, Smith portrays “the invisible hand” as a powerful, superhuman force that makes things turn out right, in spite of human selfishness and rapaciousness. Either way, Smith’s premise is based on faith, rather than on observation.

If, however, one looks at human experience rather than invoking faith or religion, one must observe that all too often things do not turn out right. All kinds of economic calamities, not to mention genocides, natural disasters, disease pandemics, and other catastrophes have afflicted humankind since its beginnings, punishing good people as well as evil ones. In economic matters as in others, the invisible hand that makes things turn out right is often nowhere in evidence. The market often works, but sometimes it doesn’t.

Actually, Smith himself acknowledges this when he writes that despite their purely selfish intentions men “frequently” end up promoting the common good. “Frequently” is a long way from “always.” So even the founder of capitalist theory was not nearly as optimistic about “the invisible hand” inevitably creating “the magic of the marketplace” as are many of today’s conservatives. Despite this, they continue to insist on citing him as the authority for their nonsensical claims about the infallibility of laissez faire capitalism.

Would that some of Smith’s admirers also keep in mind other things he wrote. Earlier this month, former Fed Chairman Alan Greenspan, made the outlandish statement (especially given the proliferation of corporate scandals and the number of executives in jail) that “we bank on the self interest” of business people to be honest to “protect their reputations.”

Adam Smith knew much better. He was quite properly suspicious of businessmen. “People of the same trade seldom meet together” Smith wrote, “but the conversation ends in a conspiracy against the public.” Had he lived two and a half centuries later, he might have been referring to predatory lenders and dealers in credit default swaps.

Update: In his testimony on October 23 before a Congressional committee, Greenspan admitted that the current financial crisis had shaken his faith in free markets. He confessed:”I made a mistake in presuming that the self interest” of banks and other financial institutions would protect them from chaos. And when Congressman Henry Waxman suggested to the former Fed chairman that his ideology was not working, Greenspan agreed: “That’s precisely the reason I was shocked,” he replied,”because I have been going for 40 years or more with very considerable evidence that it was working very well.” Apparently, Enron, the accounting scandal and many other gross defects in free markets over the decades made no impression on him.

|