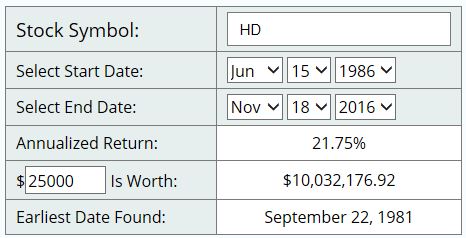

1986年美国家庭平均收入是24000左右。 我个人是比较喜欢投资与HD类似的公司股票,首先是简单,买入持有,然后就不需要其它太多的事要做了。其次,在长时间的等待过程中,可以有源源不断的现金收入(红利),并且不断的增加(红利增加了1500倍),(即使没有红利复利投入,上面的例子也有500万以上的投资回报。)。更重要的一点是,因为HD是个有长期增长能力的公司,所以即使我在投资中犯错(高价位买入),只要持有一定的时间,HD的经营业绩的增长依然可以超越我的投资错误,使我的每一分钱的投资都有回报,而且是相当不错的回报。 从个人投资者而言,一辈子能够有机会抓住1个HD这样的投资机会就足够了,而在过去30年,美国市场上至少有100家以上的公司取得了与HD类似的经营业绩,其中的许多公司我们在日常生活中都非常熟悉,沃尔玛,强生,宝洁,高度洁,可口可乐,百事可乐,Visa, MasterCard, 3M, XOM等等,你每天都使用它们的产品和服务。

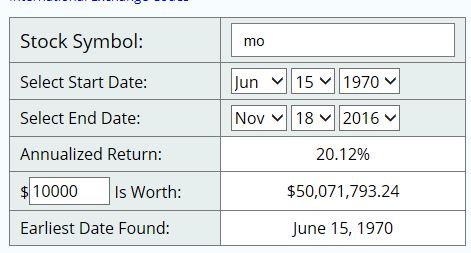

至少到目前为止,做一个美国投资者是幸运的,因为你挣钱的概率远远大于赔钱的概率。 1998-2008的十年,HD的股票投资的回报是负值,因为在此期间HD实际经营业绩非常好,所以在1998时 HD的股票被高估的程度非常惊人。从这个例子,可以看出在股票市场上做空不是件容易的事,一个股票可以被高估得很高,而且可以时间很长。大多数优秀的长期蓝筹红利股都有被长期高估的情况,所以要从一个价值投资者的角度买入这类股票的机会也不是常有的,因此,遇到机会时,要特别珍惜。 基本上任何长期业绩优秀的公司股票被高估是常态,而被低估,长期低估是极其罕见的,美国烟草公司(MO)可能是个特例,MO是在非常长的时期内反复被政府打压(加税,罚款,禁烟条例,健康索赔官司等等),所以过去MO的市场估值长期偏低。几十年被长期低估是MO能成为过去50年最优秀的十大股票之一的一个重要原因,因为它提供了极好的复利投资机会,而复利又是投资中的核武器。

下面有网友用自己的实例说明了在HD的股票上四年有400%的获利,这是个非常好的投资回报。根据该网友以前的帖子,我估计他应该有几万元的获利,因为股票投资不是他最重要的投资方向,或许他的实际利润更多,但是终究这只是他总资产的一小部分。所以虽然400%的投资回报是非常高的,但是对该网友的实际经济状况(总资产)影响有限。 在大千,经常有网友说自己在一天内获利20%,40%,甚至更多,比如最近宝地主就好多次取得了这样的投资佳绩,但是宝地主也常说自己是随便玩玩,挣点小钱。 上面二位网友的股市投资回报是极其出色的,但他们对股市投资都不是太认真,因为这不是他们主要的赚钱方向。 我在一月份时写过关于加国地产基金的投资贴子,这一次的地产基金的价格波动大致是20-35%之间,也就是投资获利大概在20-30%之间,这个投资回报率比起前二位要差,但是这一次的地产基金投资成功对投资者的影响却远远大于前二位投资者。地产基金投资者从今往后,每年有十几万的比较稳定的投资收入,这足以改变今后的人生道路。 I've learned many things from him (George Soros), but perhaps the most significant is that it's not whether you're right or wrong, but how much money you make when you're right and how much you lose when you're wrong. - Stanley Druckenmiller as quoted in The New Market Wizards

The trouble with you, Byron [Byron Wein – Morgan Stanley], is that you go to work every day [and think] you should do something. I don’t, I only go to work on the days that make sense to go to work. And I really do something on that day. But you go to work and you do something every day and you don’t realise when it’s a special day. - George Soros 巴菲特:“當天上掉金子的時候,應該用大桶去接,而不是杯子。 ” 在巴菲特投资可口可乐时,他投入了40%的总资产,目前他的72%投资组合在前4个股票仓位中。索罗斯和巴菲特的投资仓位策略是个比较高级的投资理念,高级不是高深莫测,指的是重要性,其背后的基本数学原理是非常简单的,人人都能理解,但是能做到的人很少,可能就像芒格讲的,因为太简单了,所以没有人愿意做。 They bet big when they have the odds. And the rest of the time, they don't. It's just that simple. 2010年,芒格的演讲 ART OF STOCK PICKING Here again, look at the pari-mutuel system. I had dinner last night by absolute accident with the president of Santa Anita. He says that there are two or three betters who have a credit arrangement with them, now that they have off-track betting, who are actually beating the house. They're sending money out net after the full handle a lot of it to Las Vegas, by the way to people who are actually winning slightly, net, after paying the full handle. They're that shrewd about something with as much unpredictability as horse racing. And the one thing that all those winning betters in the whole history of people who've beaten the pari-mutuel system have is quite simple. They bet very seldom. It's not given to human beings to have such talent that they can just know everything about everything all the time. But it is given to human beings who work hard at it who look and sift the world for a mispriced be that they can occasionally find one. And the wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don't. It's just that simple. That is a very simple concept. And to me it's obviously right based on experience not only from the pari-mutuel system, but everywhere else. And yet, in investment management, practically nobody operates that way. We operate that way I'm talking about Buffett and Munger. And we're not alone in the world. But a huge majority of people have some other crazy construct in their heads And instead of waiting for a near cinch and loading up, they apparently ascribe to the theory that if they work a little harder or hire more business school students, they'll come to know everything about everything all the time. To me, that's totally insane. The way to win is to work, work, work, work and hope to have a few insights. How many insights do you need? Well, I'd argue: that you don't need many in a lifetime. If you look at Berkshire Hathaway and all of its accumulated billions, the top ten insights account for most of it. And that's with a very brilliant man Warren's a lot more able than I am and very disciplined devoting his lifetime to it. I don't mean to say that he's only had ten insights. I'm just saying, that most of the money came from ten insights. So you can get very remarkable investment results if you think more like a winning pari-mutuel player. Just think of it as a heavy odds against game full of craziness with an occasional mispriced something or other. And you're probably not going to be smart enough to find thousands in a lifetime. And when you get a few, you really load up. It's just that simple. |