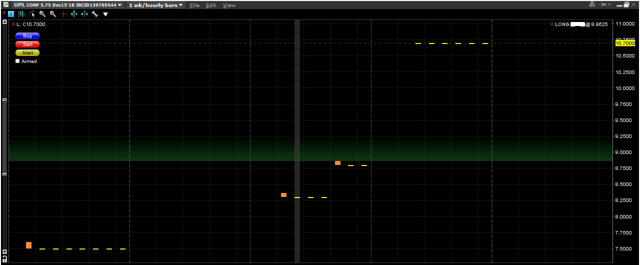

The recent face-ripping rally in Ultra Petroleum (NASDAQ:UPL) stock provided the potential for a pair trade. Last Thursday, we went long 2018 unsecured bonds at $8.80 and shorted an equal amount of UPL stock at $1.35. Total portfolio exposure on both sides of the trade is slightly more than 1%.

We believe UPL will either file a pre-pack or enter into Chapter 11 reorganization. The best-case scenario for equity holders is that they don't get wiped out completely and will be left with a small percentage in a new company. With its current capital structure, UPL is a walking zombie, so any restructuring would have to include a substantial reduction in company's debt.

The current capital structure of UPL has been discussed in much detail by other Seeking Alpha contributors, and as such I don't want to be redundant in repeating what already has been well covered. There is $2.4 billion of debt that is senior to company's unsecured bonds, and therefore, it is possible that unsecureds have very little value left. The market clearly believes so, given that unsecured debt is trading below 10% of par value.

However, if we were to assume that unsecured debt is worthless, equity would have an intrinsic value of zero. Thus, there was a clear dislocation in the market with the equity trading above $200 million at some point on Thursday and Friday, whereas unsecured debt was trading at $135 million in total for both maturities.

We believe capital restructuring will take place one way or another, and the ultimate outcome will be that unsecured holders will have, by far, a larger stake in the new company than current equity holders. In such a case, it makes plenty of sense to enter this pair trade as the worst-case scenario would imply that both positions end up being zero (a wash for the pair trade). On the other hand, in a possible reorganization, market value of unsecureds in the new company will exceed the market value of the current equity, resulting in a significant profit for this trade.

The real risk with this trade will arise if UPL somehow survives with its current capital structure. Given the company's debt levels relative to its cash-generating ability - even at WTI in the $50s and natural gas around $3 - there is a negligible chance of such an outcome. However, even if such an improbable scenario materializes and the current capital structure remains in place, there is still major upside to our long bond position with 65% annual yield on the investment and 12-fold capital gain potential if the bonds are made whole. Basically, the equity would have to trade above $20 per share to offset potential gains from the bond price appreciation.

We think such a scenario is farfetched and assign a very low probability to it occurring. Our base case is that equity will be mostly wiped out and unsecureds will ultimately end up with a larger share in the new company. We might close the trade prior to the ultimate decision on capital restructuring if the trade generates satisfactory profits. Currently, both legs of the trade are positive, with the equity trading below $1.35 and bonds settling above $10 as of last Friday's close.

Disclosure: I am/we are long UPL 2018 BONDS, SHORT UPL STOCK.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.