股市小书生

价值投资

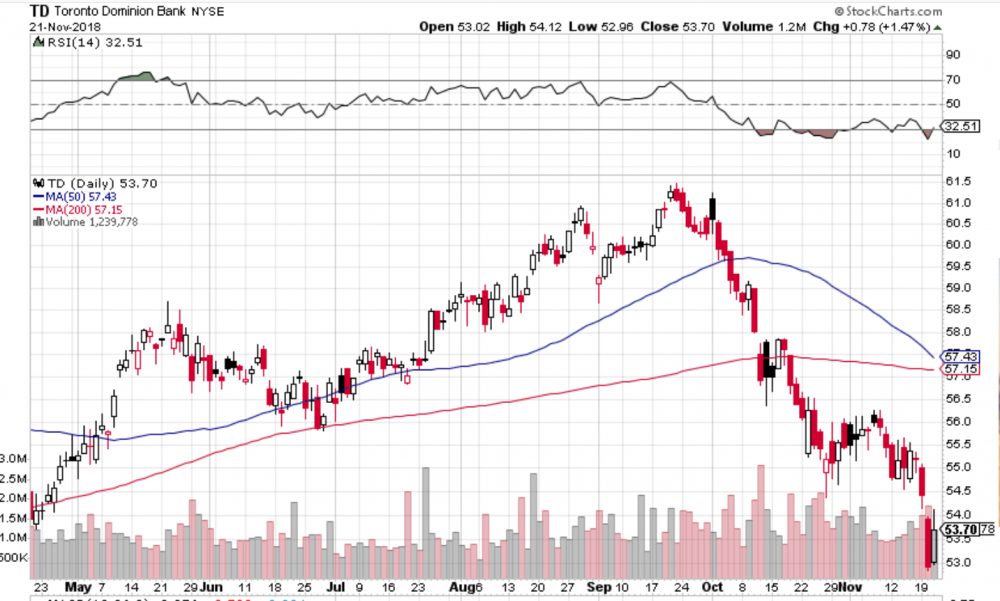

昨天有网友说 “加国银行TD, 跌幅不小。”

YTD,TD的投资回报率是-0.19%,一般这样的跌幅都是被忽略不计的。

一年的投资总回报是0%,没有任何跌幅。

简单的理解网友指的是从今年的最高点到目前的价位的下跌幅度,52W 高位80.05,目前71.04,向下波动幅度-11.5%,美金价格计算是-13.5%,从个股看,这样的波动幅度应该还是在正常范围之内。

对比一些美国市场股票的波动幅度,目前股价与年内最高点相比:

HD下跌-21.4% ,JPM下跌-10%,WFC下跌-21%,AMZN下跌-27%,APPL下跌-24%,FB下跌-38%。

从短期股价波动操作而言,TD不是一个理想的标的,因为有许多股票的波动幅度比TD大一倍左右。我以前多次写过,美国的投资者是没有必要关注加国市场的,因为美国市场的各类机会要比加国市场多十倍以上。

单从TD的股价波动幅度看,市场整体还是认可TD的商业盈利能力的稳定性和估值水平的,所以股价波动幅度有限,这对长期投资者而言不是件好事,因为很少能够有机会低价/高性价比的买入机会,你不太容易买到低价/低估值的TD股票,因为市场的主力资金心里清楚TD是怎样的一家公司,买卖双方都不会轻易的给另一方机会。TD的市场PE估值长期以来都是加国银行股中最高的,一般会高出10-20%,这是市场对一致公认的加国银行中最优秀者的估值溢价,也是资本市场的基本规律。

目前市场整体下跌了不少,所以现在应该算是一个非常差的价格点位。

如果是三年前买入的TD股票,现在是什么状况呢?

2018 45.19%

2017 45.75%

2016 45.87%

2015 48.77%

2014 83.83%

2013 45.94%

2012 114.78%

2011 18.41%

2010 23.85%

2009 12.11%

2008 -23.53%

2007 48.62%

2006 70.54%

2005 97.67%

2004 33.95%

2003 11.57%

2002 -7.74%

2001 59.70%

2000 58.40%

1999 121.39%

1998 102.10%,

在过去二十年,每年的11月22号买入TD,持有三年,平均获利49.92%。为什么是49.92%呢?可不可以是其它数字呢?不可以,因为TD的ROE长期均值是15%,1.15的三次方是1.52,所以这个数字必须是在50%左右,不可能多,也不可能少。

We've really made the money out of high quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the big money's been made in the high quality businesses. And most of the other people who've made a lot of money have done so in high quality businesses.

Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result.

So the trick is getting into better businesses. And that involves all of these advantages of scale that you could consider momentum effects. - 芒格

芒格谈论的是投资的基本规律,所谓的规律就是必然会发生的事。

在二十年中,为什么会有二次负数呢?投资者该如何认识呢?

In October of 2009, Charlie Munger was interviewed on the BBC.

Here's what he had to say about Berkshire Hathaway's (BRKa) stock (it was down quite a bit at the time) and, more generally, the decline in common stocks.

So how much does Charlie worry when Berkshire's common stock declines?

"Zero. This is the third time that Warren and I have seen our holdings in Berkshire Hathaway go down, top tick to bottom tick, by 50%. I think it's in the nature of long term shareholding of the normal vicissitudes, in worldly outcomes, and in markets that the long-term holder has his quoted value of his stocks go down by say 50%. In fact, you can argue that if you're not willing to react with equanimity to a market price decline of 50% two or three times a century you're not fit to be a common shareholder, and you deserve the mediocre result you're going to get compared to the people who do have the temperament, who can be more philosophical about these market fluctuations."

In this BBC interview with Warren Buffett, also from back in 2009, here's what he had to say

about the nature of stock markets.

"The very liquidity of stock markets causes people to focus on price action. If you buy an apartment house, if you buy a farm, if you buy a McDonald's franchise you don't think about what it's going sell for tomorrow or next week, or next month, you think about how is this business going to do. But stocks with this huge liquidity suck people in and they turn what should be an advantage into a disadvantage."

在今天买入TD股票,持有三年,有90%的概率可以获利50%。

最后再说一遍,美国的投资者是没有必要关注加国市场的,因为美国市场的各类机会要比加国市场多十倍以上。