股市小书生

价值投资

正文

网友提问为什么要优先选择TD, RY,而不是BNS?

The Bank declared its initial dividend at the rate of 3% per annum on July 1, 1833. Payments have been made continuously since.

今天BNS季报业绩良好,加季度分红。BNS的红利历史是很长的,超过了一百年,是加国历史最长的蓝筹股之一。

BNS的网站数据:

2015 季度红利是68分,现在2018是82分。

1998 季度红利是25分。

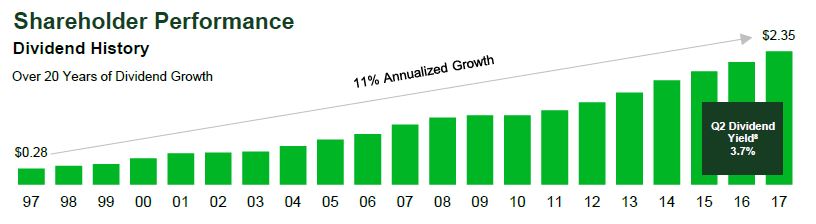

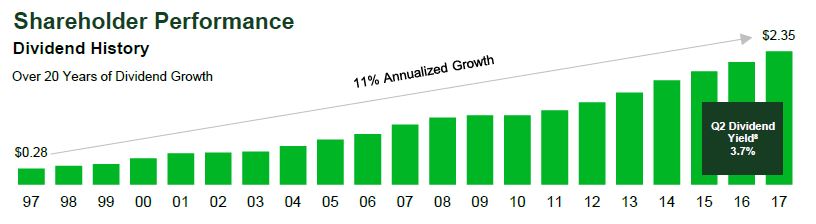

TD的网站数据:

2015 季度红利是51分,现在2018是67分。

1998 季度红利是8分。

在现实中,大多数的普通投资者会优先选择BNS, 因为市场估值低和业务上的Diversification。

The Bank declared its initial dividend at the rate of 3% per annum on July 1, 1833. Payments have been made continuously since.

今天BNS季报业绩良好,加季度分红。BNS的红利历史是很长的,超过了一百年,是加国历史最长的蓝筹股之一。

BNS的网站数据:

2015 季度红利是68分,现在2018是82分。

1998 季度红利是25分。

TD的网站数据:

2015 季度红利是51分,现在2018是67分。

1998 季度红利是8分。

TD的红利增长率明显要高出BNS,因为TD的PAYOUT的百分比是加国所有银行中最低的,所以TD的盈利增长率同样高出BNS, RY的情况大致接近于TD。

11% 年增长是个相当不错的业绩,在1997年5万年薪是极普通的工薪收入水平,如果能够有11%的年均增长,现在是40万年薪,是加国TOP1-2%的工薪收入水平。

长期投资优先选择TD,RY,是对芒格的投资思想实际运用。

TD,RY的市场估值长期高出BNS10-20%,这也完全符合了芒格的观点,这里多出10-20 %的价格是值得的。11% 年增长是个相当不错的业绩,在1997年5万年薪是极普通的工薪收入水平,如果能够有11%的年均增长,现在是40万年薪,是加国TOP1-2%的工薪收入水平。

长期投资优先选择TD,RY,是对芒格的投资思想实际运用。

Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result.

So the trick is getting into better businesses. And that involves all of these advantages of scale that you could consider momentum effects. - 芒格

在现实中,大多数的普通投资者会优先选择BNS, 因为市场估值低和业务上的Diversification。

评论

取经的徒弟

2018-08-28 11:13:25

回复

悄悄话

谢谢

登录后才可评论.