njrookie's random thoughts

A collection of my posts on investment, trading, and life...I have been reading a lot for OIL these days. Here is a 2-month old article that clarifying things about the three different measures of breakeven costs by country and methods of extraction:

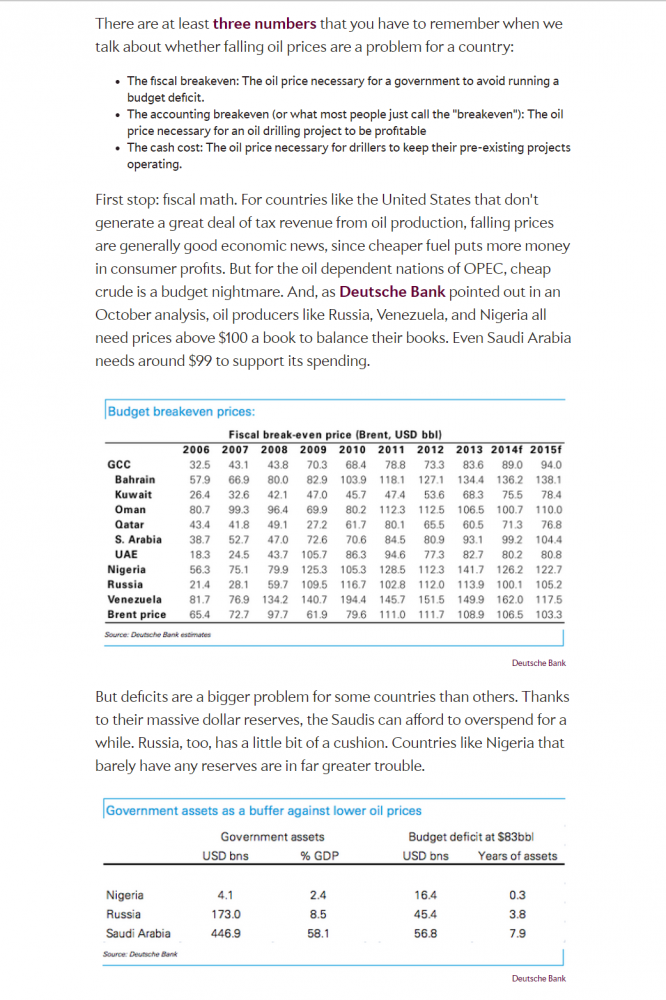

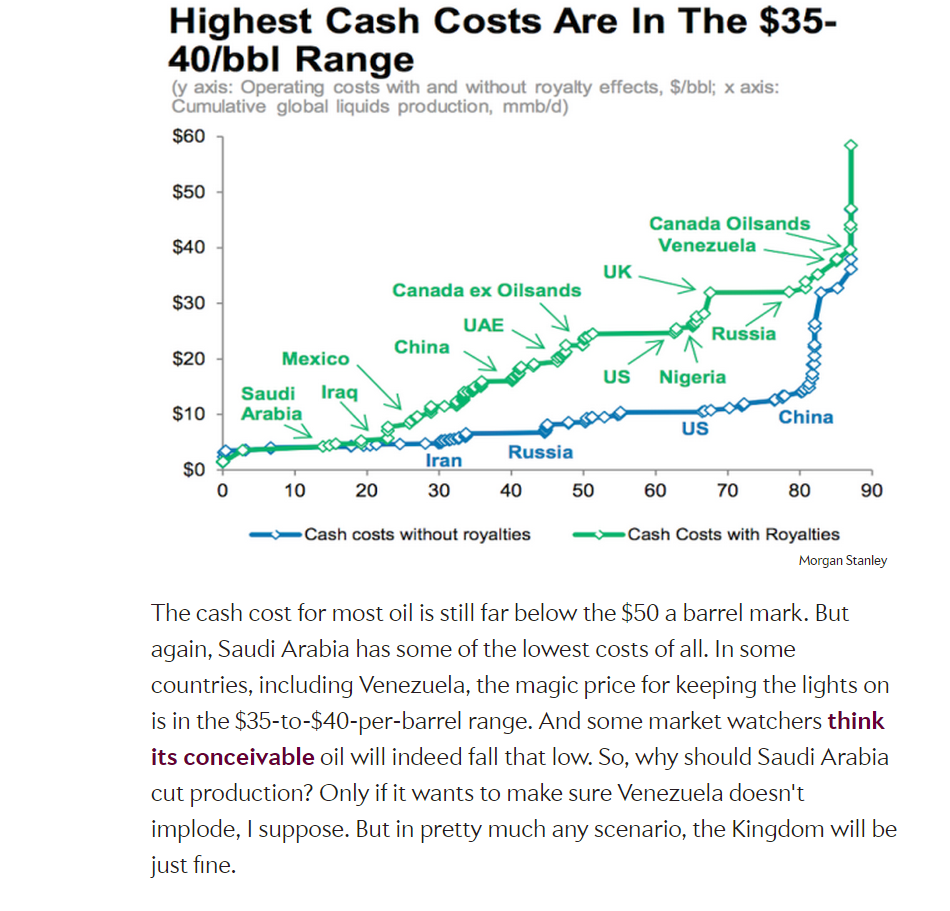

1. cash break-even price, ie the cost of extracting oil off the ground after well has already been drilled;

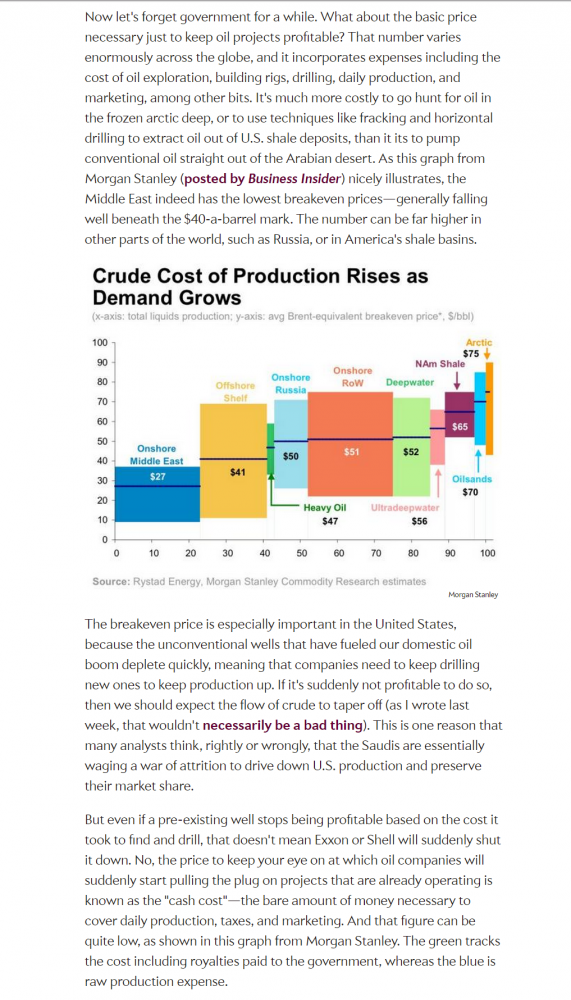

2. accounting break-even price, ie the price necessary for an oil drilling project to be profitable;

3. fiscal breakeven, ie the price necessary for a government to avoid running a budget deficit (which will run down their foreign reserves).

Given the cost structure, it is to the best interest of Saudi and other low cost producers to keep the oil price of just below the accounting break even price of high cost producers (that is cash cost plus the pro rated cost of exploration and drilling) in order to gain market share to make up for lost revenue due to lower price. In this case, the US shale oil industry will cut down drilling and payroll rapidly as the cost of entry is relatively low and depletion is fast.

So what is the trade given this assumption? $40 oil is NOT good for anyone, not even Saudi as it reduces revenue. $60 is or higher will attract new entrance. So if Saudi is smart they will try to talk the price up if it is in the $40s, and down if it is above $60s. Some kind of short strangle trade will achieve this goal.

Just my 2c