笨狼发牢骚

发发牢骚,解解闷,消消愁

正文

【这是华为上传的视频,昨天的。】

参与的,都是慕华派(国内叫“任正非将对话两位当代思想家”),再提提“反华是美国外交国安史上少有的观念泡沫,团体迷思(Groupthink)”(美俄网络战开打),在美国,大家对温和派(慕华派是“朋友”,温和派只是不打打杀杀)的第一反应是“华为给了他们多少钱?”

华为的艰难处境,大家是知道了:

《彭博》

Huawei sales and marketing managers are internally charting a drop in volumes of anywhere between 40 million to 60 million smartphones this year, the people said. That’s a big chunk of an international business that in 2018 accounted for almost half of the 206 million phones it moved

《路透焦点》美国芯片商悄悄游说政府 盼放宽华为禁令

未谈已僵:习特会还有什么好谈的?

目前已经知道的,是双方都说谈是好事,却都做好了谈崩的打算;双方都强调自己的底线,给人以明知没戏,却坚持要试试的感觉【6】,也许外交通常是在无解现实里寻找出路,存异求同。

双方的态度,大概是中国暗中急,美国公开急。打破僵局是习近平“接了淳朴(美国总统Donald Trump,人称特朗普或川普)的电话”,据《华邮》说淳朴迫不及待开谈,让大家难为情(“The administration has been desperate for these talks for weeks. It’s been painful to watch”)。美方说主动搁置第二批关税,中方说如果不搁置,中方根本不会谈【7】。

可是《华尔街日报》今天的消息说中国把华为当成成否的底线之一【1】,而《路透社》稍后却说美方不会给华为解禁【2】。

双方通过内幕造势已经成为正常手段,美国尤其技高一筹:

“The Trump administration has done such a good job of threatening China through brinkmanship that the Chinese now don’t know if they can trust the administration to arrive at any type of agreement.”【5】

两国的媒体都各自积极参与,因为是不是事实无关紧要,反正也搞不清楚,第一时间抢先发表成了报道的准则【9】,结果你要是多花时间追踪,反而会糊涂,因为你在分析别人设下的圈套,“理性分析”成了梦里的游戏,枉自折腾。

淳朴的话不能当真,也不能当假,中国不变应万变未必是妙招,但却是迫不得已情况下唯一的应对(《华尔街日报》:Mr. Xi isn't expected to take a confrontational tone with Mr. Trump, according to the Chinese officials【1】)。至于预测有什么结果,纯属徒劳,还是老老实实等消息。

【资料】

【6】《南华早报》China welcomes ‘actions that avoid US trade war dispute escalation’ ahead of Trump-Xi G20 meeting

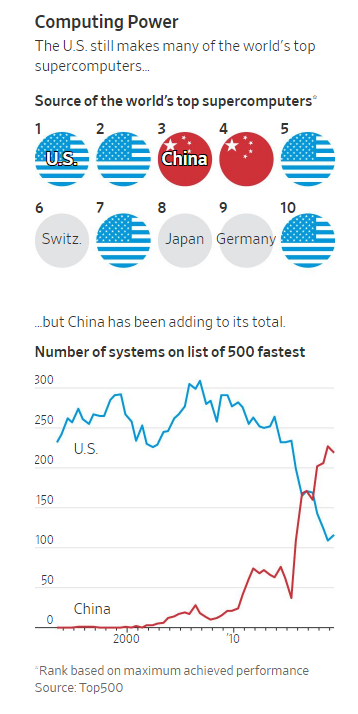

Advanced Micro Devices revived its fortunes through the deal, and sparked a national-security battle

Kate O’Keeffe and Brian Spegele, June 27, 2019

Lisa Su, CEO of Advanced Micro Devices, helped turn the company around. DAVID PAUL MORRIS/BLOOMBERG NEWS

Advanced Micro Devices Inc. AMD -1.20% transformed itself from a financially struggling company to an investor’s dream in just three years, a turnaround that began with a decision to help Chinese partners develop advanced computer-chip technology.

That deal may have helped save the company, but it alarmed U.S. national-security officials, who saw it as a threat to their goal to rein in China’s supercomputing industry. Last week, after years of friction, the Commerce Department issued an order that effectively bars several Chinese entities—including AMD’s partners—from obtaining American technology.

It looked as though the U.S. had succeeded in stanching the flow of cutting-edge computer technology to China. In reality, it was too late. Chinese versions of AMD chips already have been rolling off production lines. That technology is helping China in its race with the U.S. to build the first next-generation supercomputer—an essential tool for advanced civilian and military applications.

AMD’s Chinese partner, a military contractor, already used those chips to build what may prove to be the world’s fastest supercomputer, according to high-performance computing experts briefed on the project.

The partnership with the Santa Clara, Calif.-based chip maker was a game changer for China, which has long been unable to match the U.S.’s supercomputing power because of its inferior chips, one product the country has so far struggled to master. The AMD deal gave China access to state-of-the-art x86chips, which are made by only two companies in the world: AMD and Intel Corp. They are the most dominant processor technology in use today.

“It’s the keys to the kingdom,” said retired Brig. Gen. Robert Spalding, who served on the National Security Council in 2017 and 2018 and discussed strategies to stop the AMD deal with officials at other agencies. “Everything today is built on x86.”

AMD said in a written statement that it “has and will continue to comply with all U.S. laws,” and that the technology transferred to China in the deal wasn’t as high-performing as other U.S. products commercially available there at the time.

Commerce Department officials said last week’s action was made in consultation with other agencies. It followed weeks of inquiries by The Wall Street Journal about AMD’s Chinese partnership and the belief of some government officials that AMD had plotted a sophisticated end-run around regulators.

This account of the protracted battle over the deal between AMD and the government is based on interviews with more than a dozen current and former government officials familiar with AMD’s China deal, senior chip-industry executives, lawyers and company and government filings in the U.S. and China.

When Lisa Su was named AMD’s chief executive in October 2014, the company was desperate for cash, its debts were mounting and its revenue was declining. Its stock had dipped to around $3 a share. Some analysts predicted it would seek bankruptcy protection.

Three weeks after getting the top job, Ms. Su, a Taiwan-born New Yorker, jetted to Beijing to meet officials at China’s Ministry of Industry and Information Technology. A Chinese vice minister urged her to partner with China “to achieve mutual benefits based on AMD’s technological strength,” according to a ministry press release at the time.

In February 2016, AMD reached a joint-venture deal involving a leading Chinese supercomputer developer, a state-backed military supplier called Sugon Information Industry Co., to make chips licensing AMD’s x86 processor technology.

“Making contributions to China’s national defense and security is the fundamental mission of Sugon,” its website read as recently as December 2016. Sugon also makes computers for civilian use.

In exchange, the Chinese government gave AMD a lifeline: $293 million in licensing fees plus royalties on the sales of any chips developed by the venture.

That April, AMD got another boost from Beijing. It said it would get a $371 million payout for selling an 85% stake in two of its semiconductor factories in China and Malaysia to an entity controlled by China Integrated Circuit Industry Investment Fund Co., a state-backed financier known as “the Big Fund.” Its mission is to develop China’s indigenous chip industry.

Scientists examine a prototype of China's next-generation exascale supercomputer at the National Supercomputer Center in Tianjin

The U.S. and China are competing to develop the world’s first exascale computer, a next-generation supercomputer that would be capable of doing one quintillion—or one billion billion—calculations per second. While supercomputers are used in tasks such as weather forecasting and cancer research, they also are integral to the development of nuclear weapons, encryption, missile defense and other systems. The chips American companies produce to power supercomputers, including AMD’s x86, are superior to any China can make on its own.

“Semiconductors are a space where the U.S. still leads China and the rest of the world,“ says William Evanina, the U.S. government’s top counterintelligence official.

Shortly before AMD announced the Sugon deal, Defense Department officials learned of a presentation the joint-venture partners made in China talking up the deal’s potential to transform the country into a leader in processor technology.

Pentagon officials quickly began seeking ways to unwind the deal, according to people familiar with the matter. They questioned company representatives and repeatedly tried to get them to submit the deal to a review by the Committee on Foreign Investment in the U.S., or Cfius, according to those people.

Companies routinely seek approval from the committee for deals that raise national-security issues. The committee is led by the Treasury Department and includes the Defense, Commerce, Justice and Energy departments, among others. It can recommend that the president block foreign investments in U.S. assets for national-security reasons.

AMD didn’t submit the deal for committee review, arguing Cfius didn’t have jurisdiction to review that type of joint venture, according to people familiar with the matter. The company also claimed it wasn’t turning over any state-of-the-art technology. Pentagon officials found that response at odds with how the joint venture had portrayed itself in China.

Treasury officials, who have the final say on the consensus-driven Cfius panel, ultimately agreed with AMD’s assessment that the deal fell outside its remit. That left AMD and Defense officials at a stalemate through the end of the Obama administration and the first months of the Trump administration.

A Treasury spokesman declined to comment, as did the Defense Department.

Commerce Department officials also were investigating the deal for compliance with export controls. In June 2017, following a series of inquiries, they sent AMD an “is informed letter” that alerted the company they suspected the China deal violated export controls. AMD replied that it was complying with all regulations, according to people familiar with the matter.

In its statement to the Journal, AMD said that starting in 2015, it “diligently and proactively briefed the Department of Defense, the Department of Commerce and multiple other agencies within the U.S. government before these joint ventures were entered into, and we received no objections to their formation or the transfer of technology.”

Before the transfer of any technology, AMD said, the Commerce Department notified the company that it wasn’t restricted or otherwise prohibited from being transferred.

Current and former national-security officials said in interviews they believe AMD designed the deal’s complex structure, which involved the creation of two interlinked joint ventures, to sidestep U.S. regulations. AMD said the deal was structured for business and technological reasons and to comply with regulations, not to evade them.

AMD controls the first joint venture, which licenses the U.S. chip maker’s x86 intellectual property and manages production of the chips. The second venture, controlled by AMD’s Chinese partner, designs the devices that use the chips and sells the final products.

China’s new chips are based on AMD’s own EPYC processors

The arrangement enables AMD to share technology with China while retaining control over the entity working with its intellectual property. The creation of the second, China-controlled joint venture allowed the parties to claim that the resulting product was indigenously developed in China, a key goal of the Chinese government.

While Cfius has jurisdiction to review foreign purchases of U.S. chip assets, it doesn’t have clear authority to review overseas joint ventures that don’t grant a foreign entity control over a U.S. business.

AMD didn’t have to seek an export license from the Commerce Department because it stripped out the parts of its x86 chip that would have required licenses, such as encryption technology, which China didn’t need anyway.

The x86 chips under development for China, code-named Dhyana, are similar to AMD’s own EPYC chips, minus U.S. encryption technology that AMD omitted, say people familiar with the deal.

The joint venture’s U.S. managers stressed to employees that the Dhyana chip was being developed for commercial purposes, such as providing processing technology to Chinese tech giants such as Baidu Inc. or Tencent Holdings Ltd. , according to one of the people familiar with the deal.

Sugon, however, told state-run media that the x86 technology could serve China’s bid to build the world’s first exascale supercomputer. The joint venture’s job postings in Chinese implore candidates to help strengthen China’s domestic chip ambitions.

Sun Ninghui, head of the computing-technology institute at the Chinese Academy of Sciences, which works closely with Sugon, likened its chip development strategy to what China did with high-speed trains—introduce a foreign technology to the market, absorb it, and then innovate to make China a leader.

“This gradually advances our ability to comprehend their core technologies,” Mr. Sun told a government-run newspaper. “That way, we no longer can be pulled around by our noses.”

By mid-2017, concerns about AMD’s China deal had reached the Trump White House. Retired Gen. Spalding, who left the National Security Council last year, said of AMD: “They’re using the letter of the law to violate the spirit of the law.”

In November 2017, Sen. John Cornyn (R., Texas) and then-Rep. Robert Pittenger (R., N.C.) introduced legislation to expand Cfius’s authority, including broader powers to review joint ventures overseas.

There was heavy opposition from many companies and trade organizations, which feared Cfius interfering in their overseas activities, and the provision didn’t make it into the final version of the legislation that passed in August 2018.

Defense Department officials decided to unilaterally submit AMD’s Sugon deal to Cfius for review, despite Treasury’s earlier interpretation that it fell outside the panel’s jurisdiction. Only rarely in Cfius’s 44-year history has the committee been asked to review deals without the cooperation of either party involved, according to lawyers who track the confidential cases.

As the Cfius filing sat in limbo, Lisa Porter, the Defense Department’s deputy undersecretary for research and engineering, criticized AMD’s China deal in front of industry executives. AMD officials hired Beacon Global Strategies, a Washington-based consulting firm that employs former top national-security officials, to try to make peace.

On June 21, however, the Commerce Department announced the new export restrictions banning Sugon and its affiliates on the AMD deal from accessing U.S. technology without a license. The move, which followed the imposition of similar export restrictions last month targeting Chinese telecommunications giant Huawei Technologies Co., effectively forces AMD to unwind the deal.

In its decision, the Commerce Department said the Chinese entities were determined “to be acting contrary to the national security or foreign policy interests of the U.S.” It added: “Sugon has publicly acknowledged a variety of military end uses and end users of its high-performance computers.”

In a statement on its WeChat account, Sugon said the decision would severely disrupt its cooperation with U.S. partners. It said it had complied with all U.S. laws and would seek to discuss the issue with U.S. officials. “We believe there is a large gap in the understanding of Sugon’s corporate circumstances on the part of relevant U.S. authorities,” it said.

The Commerce action will make it hard for China to make future generations of the x86 chip, and it’s unclear if AMD’s partners will be able to continue producing the current version without the U.S. company’s technical assistance, according to experts in semiconductor technology. But China gained significant technical know-how through the deal, which has already yielded chips currently powering supercomputers.

For AMD, pushing back against U.S. national-security officials while its China partnership gained traction paid off. The chip maker used the cash infusion to get back on its feet and has since introduced an array of competitive new products.

The company’s stock price has risen to around $30 per share recently, from under $2 in early 2016. AMD’s shares were the S&P 500 index’s top performers last year, rising nearly 80%.

怛罗斯之战和东西之分

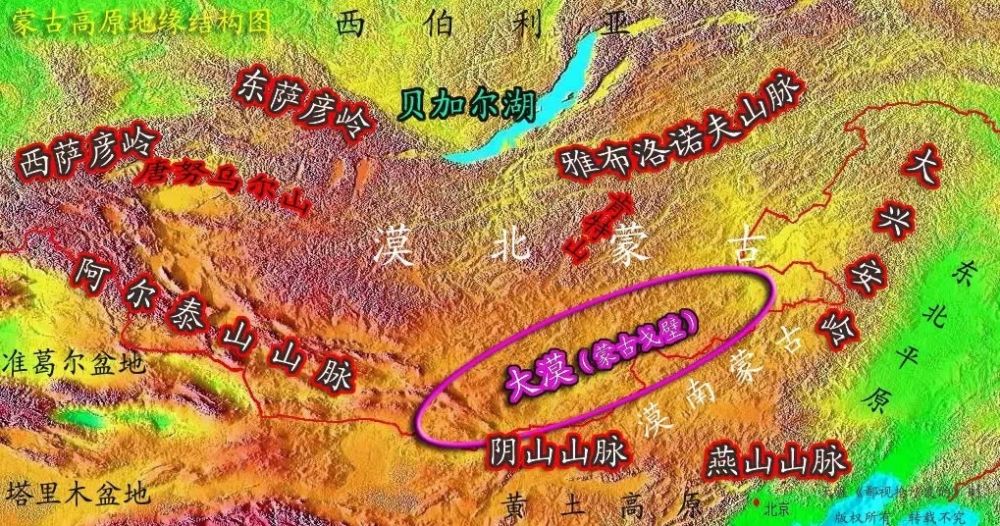

所谓欧亚草原历史上的游牧民族的主要人口来源来自东部,尤其是中国北部,漠北地带(现已不属中国)。不过从人种来看,因为迁移融合,居住在这片广袤的草原上的绝对不仅仅是黄种人,白人也不少。这里大部分的人都被称之为“突厥”(中国历史上的分类详细的多,除了匈奴蒙古,辽(契丹)金(女真)夏(党项)回纥(回鹘,今维吾尔族)满,和回族,都是大族),所以“突厥人”是个莫名其妙的大杂烩,实在说不清什么是真正的突厥人,远比“汉族”为复杂。草原的游牧生活在人口处于平衡点附近的时候,不能人太少啥事也干不成,不能人太多大家张口等吃,畜牧为主,其它农业和日用品都来自领进的农耕民族,和农耕地区交易加上掠夺,生活还挺惬意。

游牧民族的特色是其机动性,但因为财富无法得以积聚,机动性的代价是落后,最显著的是人口,游牧民族的人口和农耕民族经常差了一到两个数量级,个人和家庭的欲望必须得到有效的抑制,神和强权是这种机制的基础,征伐和掠夺是畜牧和贸易之外非常关键的生存策略,征伐和掠夺既可以增加财富,也提供了凝聚力,给领导集团带来威望和合法性,同时带来一种本族在神坛存在的合法性,精神政治都是关键的因素。

(两图的二维投射方法不一致,卫星图绿色地带并不一定代表草原)

Early patterns of migration(大英百科全书)

These geographical conditions meant that nomads of the Eastern Steppe, living as they did in one of the most severe climates of the Earth, were under constant temptation to move in one of two directions: either southward and eastward toward Manchuria and northern China or westward, passing between the Altai and Tien Shan along the valley of the Ili River and the shores of Lake Balkhash, toward the more inviting grasslands of the Western Steppe. Migrations and conquests funnelling through this Dzungarian Gate, as it is often called, gave the peoples of all the steppe a common history from the onset of horse nomadism

汉代和唐代对漠南漠北和西域的扩展,既反映了中土农耕文明相对于游牧民族的优越性,也给现代带来的反驳中华文明自愈不扩张文明的籍口。然而农耕文明和游牧文明如棋逢对手,虽然农耕文明经济实力远远超于游牧文明,但游牧文明政治的专制,文化上的单一和军事的机动性却是农耕文明无法抗衡的,一旦出现一个强有力的领导集团或人物(如冒顿单于,成吉思汗),其集中性反而成了对农耕文明的致命对手。

农耕民族一直缺乏游牧民族的有效的策略,征服融合不现实,结果大多采纳地缘为主的防御性策略,联姻、封赏、贸易特别优惠国等是基本策略。举个例子,罗马在屋大维高峰期也指定多瑙河的极限,后来鲁莽的罗马军团一旦冒进,就有被德国“蛮民”

汉唐的“扩张”的出发点一是巩固两个区域交锋边界,形成战略纵深,而是打通、维护贸易通道,尤其是向西域的丝绸之路。不过这扩张不论多辉煌,都有一个严峻的现实:军事扩张的经济代价庞大,当时的生产力无法形成过度剩余,所以即使如中国那么讲究综合兵种和补给的军队,其战果也不足以平衡国家的经济负担,故此即使是唐汉盛世,扩张很快带来了衰退。

“唐朝开国之后逐渐结束了自隋末以来的群雄割据局面并统一了全国,唐太宗和唐高宗执政期间不断对突厥、薛延陀、吐谷浑、西域诸国(高昌、龟兹等)等国家作战并消灭了这些政权,由此逐渐控制了漠南、漠北、西域等地区”

公元599年以后,东西突厥均臣服于隋王朝

唐初,东突厥势力渐起,除并吞邻近许多民族外,还奴役处于漠北的铁勒诸部。公元629年以后,唐军连续发动对东突厥军事行动,最终将其灭亡,其余部逐步溶入华夏民族

在灭东突厥之后,唐军开始对西突厥用兵,先打败吐谷浑打通河西走廊,并在公元639——657年间的连续战争中击败了西突厥,完全控制了葱岭以东天山南北。西突厥被唐王朝击败后,余众大举西迁(如俄罗斯顿河流域的波洛伏人即是突厥一支),其中另一支突厥人后来在中西亚建立了塞尔柱突厥帝国

十二世纪末,塞尔柱突厥帝国衰落,其部将在里海南岸建立了花剌子模国,到十三世纪时国力开始强盛,领土东至印度河、西到波斯湾、北接阿塞拜疆的广大地区

怛罗斯之战,黑衣大食胜

仅仅一百年后:(无关)

评论

目前还没有任何评论

登录后才可评论.