笨狼发牢骚

发发牢骚,解解闷,消消愁经济效率(Productivity)的定义,参见美国经济的心病。

以前数次提到近来多年美国经济效率一直停滞不前,成了经济学家的心病:

美国经济的几个怪现象

美国那日落黄昏的制造业岗位

美国经济效率文集

也是经济学家难以理解的难题。

最近有人把这归咎为美国急功近利,用虚的把自己给坑了:

经济效率1972年既已达顶峰:

原因是什么?是“经济转型”转到了“金融手腕”(Financial Engineering),用手腕成了经济的主要动力:

此文还讽刺当今“数码经济”,“互联网时代”,说是大家与世界“接连”的时间大增,知识效率都大幅提高,但谁说大家不是去打游戏聊天儿了?

要证明吗?今天美国劳工统计局公布今年一季美国经济效率,伤心。

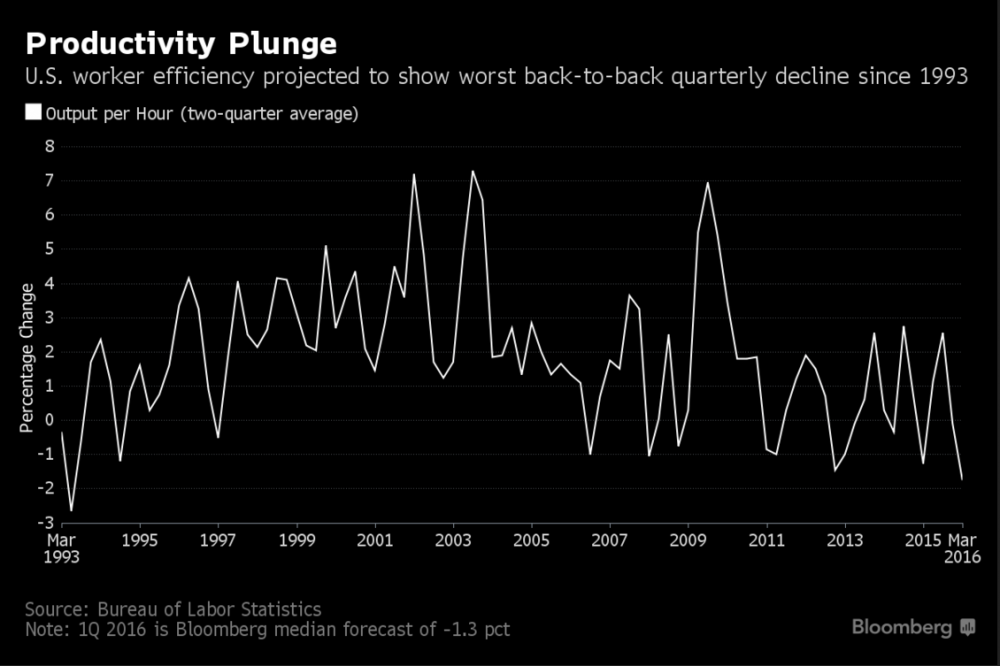

《彭博》U.S. Worker Productivity Hasn't Been This Bad Since 1993: Chart

《彭博》报道的标题就把情形点明了(《巴伦周刊Barron's》的标题也太逗了:Productivity Declines in Q1 as Job Market Grows Faster than Economy)。

效率低时有代价的,如《华尔街日报》报道(见下),低效率,低增长,低收入,百姓就没好日子,就怨恨。

不过也有“有大志”的要解决这难题:

《华邮博文》The productivity slump and what to do about it

作者Jared Bernstein, a former chief economist to Vice President Biden, is a senior fellow at the Center on Budget and Policy Priorities,是个经济学家了。一大堆经济术语后,他说三个办法:

(一)资本都被吴用了,用到金融业上,还是最糟的那部分(上面那讽刺也不离谱啊),得重新分布;

(二)想法子增加就业,迫使企业再想法提高效率

(三)将目前功能失调的政府翻个个,改过来

好。大家就等着习近平那样的英明领袖吧。

难道他是淳朴?

《华尔街日报》U.S. Productivity Fell 1%, Signaling Tepid Growth

Wage growth showed some progress as hourly compensation increased at a 3.0% annual rate

WASHINGTON—U.S. worker productivity fell in the first quarter, but wage growth advanced as a streak of solid job gains continued.

The productivity of nonfarm workers, measured as the output of goods and services for each hour worked, decreased at a 1.0% seasonally adjusted annual rate in the first quarter, the Labor Department said Wednesday. From a year earlier, productivity was up 0.6%.

Economists surveyed by The Wall Street Journal had forecast a 1.4% decline from the prior quarter.

Wage growth showed some progress. Hourly compensation increased at a 3.0% annual rate compared with the prior quarter. That comes after hourly compensation grew a revised 0.9% in the fourth quarter, and could be a signal that a tightening job market may be putting pressure on employers to better pay packages.

A gauge of compensation costs, unit labor costs, increased at a 4.1% annual rate in the first three months of the year—the sharpest rise in more than a year and well ahead of the 3.3% rise economists expected. From a year earlier, unit labor costs rose 2.3%.

Paul Ashworth, chief U.S. economist at Capital Economics, said the increase in labor costs illustrates that “even if economic growth is lackluster, domestic price pressures are still mounting.”

Wednesday’s data marked the fourth decline in productivity in the past six quarters, reflecting the trend of slowing productivity gains since the recession typified by relatively strong hiring but also hesitant business investment and slowing output.

Productivity, an important determinant of an economy’s long-term health and prosperity, has averaged 0.8% over the past four quarters and 0.6% over the past five years. The last similarly weak stretch was in the early 1980s—a worrying signal for the broader economy, which barely managed to eke out growth in the first quarter.

Gross domestic product, the broadest measure of goods and services produced across the economy, increased at a tepid 0.5% seasonally adjusted annual rate in the first three months of the year, according to a Commerce Department release last week. Business spending crashed, while exports tumbled and consumers showed signs of caution.

Low productivity growth slows the economy since it holds down companies’ profits and the wages they can pay workers. That is a concern for the Federal Reserve since weak wage growth can hold down inflation, and inflation has already undershot the central bank’s 2% target for nearly four years.

The economy has continued to produce jobs despite anemic output growth, in part because firms are hiring more workers to compensate for soft growth in worker productivity.

Fed officials expect the pattern to continue, according to projections released earlier this year. They see the jobless rate, which was 5.0% in March, retreating to 4.7% by the end of this year and 4.5% through 2018, lower than previously expected.