Here is the current portfolio 2015 holdings after recent adjustment.

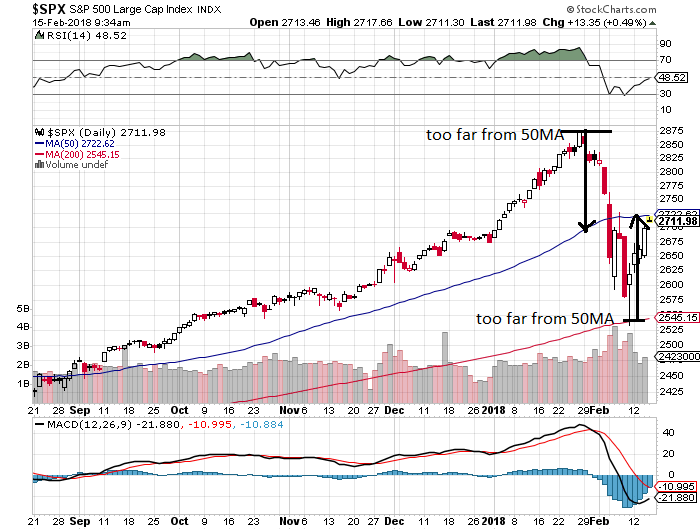

After big sell of at the begining of Feb 2018, market is having a V-shaped recovery. No idea how much steam left in it. But we do learned good lesson from recent sell off.

Here is the list:

1. Never ever sell into panic. There will be much better time to sell (like today). Sell into panic will hurt your portfolio big time because you will have to chase it at much higher level.

2. The best time to buy is blood on the street and CNBC's show 'Market in Turmoil' came out. It was scary moment however probably the safest moment to buy.

3. Don't buy any finance directives as your investment. The chance of being wiped in one day is always out there (such as XIV this time). This keeps happening, the people keep getting hurt. But you don't need to be one of them.

4. Don't involve in crowded trade. Once everyone is at one side of the boat, you need move to the other side or into the water with them.

5. Never lower your guard. Whenever sentiment is too bullish, start to buy protections. This will reduce your risk and don't get shaked out in bull market.

6. Never use margin or fully invested. Always has some cash at the sideline so you can buy dips.

7. Have long term view. Correction will happen and bear market will happen. However except 1929 corrections and bear markets never last very long. Those who invest longer term come out well.

8. Don't timing the market. There are too many people especially TA guys try to prodict the market. It never works for average investors. Prodiction is for fools.

9. Whenever an asset price is too far away from 50MA, it intends to get close to it. It is called gravity. Keey an eye on it.